PAN Card OCR Verification API Enabling Seamless Identity Verification

The Identity Verification Dilemma in Digital Systems

PAN Card OCR Verification API is transforming how digital platforms approach identity verification in India. With rising demand for instant KYC processing in fintech, telecom, and digital services, businesses can no longer afford the delays and inconsistencies of manual document checks. By using a PAN Card OCR Verification API, companies can achieve real-time validation of identity data, improving onboarding speeds and regulatory compliance.

PAN Card OCR Verification API replaces outdated, error-prone manual verification with automated extraction of user data directly from PAN card images. Traditional methods not only consume time—often 10 to 15 minutes per user—but also risk human error in reading or transcribing PAN details. In contrast, the PAN Card OCR Verification API delivers structured, machine-readable output in just a few seconds, ensuring consistency and eliminating redundant checks.

PAN Card OCR Verification API is essential because the PAN card itself serves as a core identity proof in India. Whether it’s opening a bank account, registering a business, or accessing government schemes, PAN is mandatory. Integrating a PAN Card OCR Verification API into digital onboarding workflows ensures that PAN data is validated quickly, accurately, and securely—helping businesses meet compliance goals while keeping user experience smooth.

PAN Card OCR Verification API empowers developers and organizations to build KYC systems that scale with demand. With features like RESTful endpoints, JSON outputs, and security-first design, the PAN Card OCR Verification API fits easily into modern stacks—enabling instant identity checks and reducing drop-offs in user journeys.

Behind the Scenes of PAN Card OCR Verification API

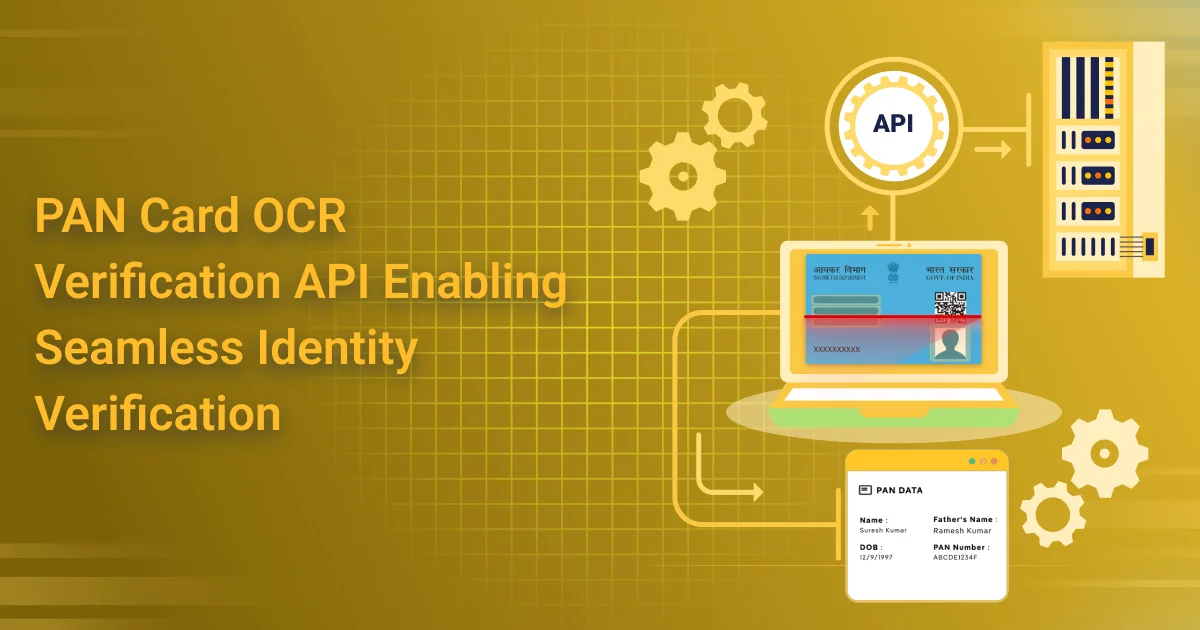

PAN Card OCR Verification API is designed to handle identity verification with speed and precision. The moment a user uploads a PAN card image, the API springs into action—executing a series of steps that transform raw image data into clean, structured, and validated identity fields. This seamless flow is what allows developers to build faster KYC pipelines while maintaining compliance.

The first stage in the PAN Card OCR Verification API is preprocessing. This involves enhancing the uploaded image for optimal OCR performance. Techniques such as noise removal, grayscale conversion, and image rotation correction are applied to standardize the image format. These steps significantly improve the quality of text detection, especially when users upload low-resolution or poorly aligned PAN card images.

Once preprocessing is complete, the PAN Card OCR Verification API proceeds to optical character recognition. Using either a customized Tesseract engine or advanced machine learning models, the API scans the cleaned image to extract critical PAN card details—such as the PAN number, full name, date of birth, and father’s name.

These models are trained specifically on Indian government-issued document formats, ensuring higher accuracy.

Following character recognition, the PAN Card OCR API enters the post-processing phase. Here, it applies strict regex validation and formatting logic to clean and standardize the extracted data. For example, it verifies that the PAN number follows the correct alphanumeric structure (e.g., ABCDE1234F). This step filters out anomalies and ensures that only valid data is returned to the client.

From a system architecture perspective, the PAN Card OCR API is typically implemented as a RESTful service. It supports both synchronous (real-time) and asynchronous (webhook-based) API calls, depending on the volume and latency requirements of the application. This allows flexibility for developers handling anything from individual user signups to high-volume enterprise onboarding.

By executing all these operations within milliseconds, the PAN Card OCR Verification API offers a powerful backend engine for identity verification—ensuring speed, accuracy, and compliance for modern KYC workflows.

Data Points Extracted Using PAN OCR APIs

PAN Card OCR Verification API is built to extract essential identity details from PAN card images with high accuracy—even when faced with diverse layouts, fonts, or image quality issues. By using advanced OCR and machine learning techniques, the API ensures that all critical fields are parsed correctly from government-issued documents.

The most fundamental data point extracted by the PAN Card OCR API is the Full Name of the cardholder. This is typically found near the top of the card, but slight variations in layout can occur depending on the PAN card version. The API uses positional anchors and text recognition algorithms to accurately isolate the full name, regardless of minor formatting changes.

Another key field parsed by the PAN Card OCR Verification API is the Father’s Name. Indian PAN cards traditionally include the father’s name below the full name, and the API identifies this through intelligent parsing logic that recognizes hierarchical name structures and spatial relationships between text blocks.

The Date of Birth (DOB) is extracted using a pattern-matching approach. The PAN Card OCR Verification API identifies DOB by detecting date formats (DD/MM/YYYY or DD-MM-YYYY) and validating them through regular expressions. This is especially useful when the card image is slightly blurred or the font varies due to older card formats.

Perhaps the most crucial field—the PAN Number—is validated with the highest precision. The PAN Card OCR Verification API applies a strict alphanumeric regex ([A-Z]{5}[0-9]{4}[A-Z]{1}) to filter out noise and ensure that it accepts only legitimate PAN numbers.

The OCR engine distinguishes between similar-looking characters (like O and 0, or I and 1), which commonly cause errors.

To further enhance data integrity, the PAN Card OCR API performs document validity and layout verification. This includes checking for the correct positioning of fields, overall layout structure, and official elements like the Income Tax Department emblem or card formatting styles. It uses template matching and edge detection to determine if the document adheres to expected visual patterns.

Even in the case of low-quality images or non-standard fonts, the PAN Card OCR API applies image enhancement filters, font normalization techniques, and character confidence scoring to maximize extraction accuracy. This ensures consistent performance across various upload conditions.

Through these intelligent extraction techniques, the PAN Card OCR API empowers developers to automate identity verification with confidence—minimizing errors, manual intervention, and compliance risks.

Industry Use Cases Beyond Just KYC

The PAN Card OCR Verification API is rapidly becoming a critical tool not only for traditional banking but also across a wide spectrum of industries that require reliable identity verification.

1. Neo-banking: With the rise of digital-only banks, the PAN Card OCR API enables instant digital account creation by automating the capture and validation of customer identity details, drastically reducing onboarding time and friction.

2. Cryptocurrency Platforms: Regulatory compliance in crypto trading demands stringent KYC checks. The PAN Card OCR Verification API helps these platforms onboard users quickly while ensuring adherence to Indian government regulations.

3. Ride-sharing and Gig Economy: Driver and contractor identity verification is vital for safety and trust. By integrating the PAN Card OCR API, ride-sharing apps and gig platforms can perform fast, accurate identity checks without manual verification bottlenecks.

4. Real Estate and Rentals: Landlords and property managers increasingly require verified IDs for digital rental agreements. The PAN Card OCR Verification API simplifies this process by extracting verified PAN details directly from submitted documents, ensuring authenticity and reducing fraud risks.

5. EdTech and Examination Services: For secure candidate identity proof collection during online exams or course enrollments, the PAN Card OCR Verification API automates identity validation—helping organizations maintain exam integrity and streamline student onboarding.

These examples clearly show that the PAN Card OCR API is not just a banking tool but a versatile solution empowering multiple sectors to accelerate compliance, improve user experience, and reduce manual processing costs.

Challenges in Building a Reliable PAN Card OCR Verification API (And How to Overcome Them)

Building a robust PAN Card OCR API involves overcoming several real-world challenges that can impact accuracy and reliability. One of the most common issues is handling crumpled, blurry, or cropped PAN card images submitted by users, which often degrade the OCR’s performance. Additionally, the variety of non-standard fonts and differing image resolutions across PAN cards further complicates text extraction.

Another major hurdle is detecting fraudulent documents, including digitally altered images or forgeries. These require the PAN Card OCR API to incorporate sophisticated fraud detection mechanisms beyond simple text recognition. Environmental factors like mobile camera glare, shadows, and uneven lighting also pose significant barriers to clean image capture, affecting the API’s ability to read details correctly.

To address these challenges, modern PAN Card OCR Verification APIs employ data augmentation techniques to train models on a wide range of distorted or imperfect images, increasing robustness. A hybrid approach combining rule-based validation (e.g., regex checks for PAN format) with AI-powered recognition enhances accuracy and fraud detection. Confidence scoring mechanisms allow the API to flag uncertain reads for manual review, maintaining overall data integrity.

By integrating these solutions, the PAN Card OCR Verification API ensures reliable extraction even from low-quality or tampered documents, helping developers build seamless, trustworthy identity verification workflows.

Accuracy Benchmarks and API Performance

A critical aspect of any PAN Card OCR API is its ability to deliver fast and accurate results across diverse usage scenarios. On average, a high-quality PAN Card OCR API processes each document within milliseconds, typically under 2 seconds, enabling real-time identity verification in applications like digital onboarding and KYC workflows.

Accuracy rates vary depending on input conditions, but leading APIs achieve over 95% character recognition accuracy when processing clean, scanned PDFs or high-resolution mobile images. Even in challenging environments—such as photos taken with mobile cameras under poor lighting or slightly angled shots—the PAN Card OCR API maintains strong performance, often above 90% accuracy, thanks to advanced preprocessing and AI-driven error correction.

Scalability is another crucial factor. Developers design robust PAN Card OCR API for horizontal scaling, enabling them to handle thousands of concurrent requests without latency spikes by using cloud-based load balancing and asynchronous processing pipelines.

This ensures consistent uptime and rapid response times during peak verification loads.

Furthermore, the API’s support for multi-language and regional adaptations is vital, especially in India’s diverse linguistic landscape. While the PAN card primarily uses English and Hindi fonts, the API’s adaptability to different font styles and minor regional script variations contributes to broader applicability in various compliance and verification contexts.

In summary, these performance benchmarks make the PAN Card OCR API a reliable choice for developers demanding speed, accuracy. And scalability in identity verification solutions.

Data Security and Compliance

Handling PAN data requires the utmost care, as the information. Processed by any PAN Card OCR API is highly sensitive and subject to strict regulatory standards. To ensure data protection, these APIs implement robust encryption protocols both in transit and at rest. TLS/SSL encryption secures PAN card images and extracted data as they travel between client applications and the API servers. Preventing interception by unauthorized parties.

Secure storage systems encrypt sensitive PAN details at rest to safeguard against data breaches or unauthorized access. Additionally, the system enforces strict API authentication mechanisms. Such as JWT tokens, OAuth protocols, or API key validation. To ensure that only authorized developers and applications can access the PAN Card OCR API endpoints.

Compliance with global and local privacy laws is paramount. Leading PAN Card OCR Verification APIs adhere to frameworks like GDPR for international users. And India’s emerging Data Protection and Digital Personal Data Protection (DPDP) Act. The API’s architecture integrates transparent data handling, user consent management, and rigorous audit trails. As mandated by these regulations, to give developers peace of mind while ensuring compliance.

By prioritizing data security and regulatory adherence. The PAN Card OCR API offers a trustworthy foundation for identity verification in sensitive digital workflows.

Smart Tips to Improve OCR Success Rates

To maximize the accuracy and efficiency of the PAN Card OCR API. Developers should encourage best practices around image capture and processing. Ensuring high-quality images at the source significantly boosts OCR success rates and reduces the need for costly reprocessing.

First, advise end users to capture clear, well-lit PAN card images free from blur, glare, or shadows. The PAN Card OCR API performs optimally when images are sharp and focused. So real-time feedback mechanisms like blur detection or live image guides can help users. Adjust their camera before submission.

Implementing auto-crop and smart edge detection features in mobile SDKs further refines. The input by isolating the PAN card from the background, improving OCR precision. These techniques remove irrelevant noise and straighten tilted or skewed cards, which are common issues during mobile capture.

Finally, running preliminary validation on the client side. Such as checking image resolution, aspect ratio, and file size. Before sending data to the PAN Card OCR API can prevent poor-quality uploads and minimize unnecessary API calls. Saving both time and bandwidth.

By combining these tips with the powerful capabilities of the PAN Card OCR API. Developers can ensure faster, more reliable identity verification experiences.

The Future of PAN OCR APIs and Identity Automation

Broader trends in digital identity. Particularly the rise of self-sovereign identity (SSI) systems. Are actively shaping the evolution of the PAN Card OCR API.

SSI empowers users with greater control over their personal data. And integrating PAN OCR technology into this framework will enable seamless. User-centric identity verification without compromising security or privacy.

The PAN Card OCR API will increasingly integrate with advanced biometric verification. Methods such as face matching and video KYC in the future. This multi-factor identity authentication approach will strengthen trust while reducing manual intervention, accelerating onboarding processes across industries.

The ultimate vision for the PAN Card OCR API is to become. A core component of a zero-friction KYC stack. One that automates document extraction, identity proofing, and compliance in a single, unified workflow. This future promises not only enhanced accuracy and speed but also a more user-friendly experience that supports. Digital transformation initiatives at scale.

Final Thoughts

The PAN Card OCR API is much more than a simple OCR tool. It’s a powerful gateway to faster, smarter, and fully compliant digital onboarding. By automating PAN card data extraction with high accuracy and minimal latency. This API helps developers streamline KYC workflows, reduce manual effort, and enhance user experience.

For developer teams looking to accelerate their identity verification processes. Exploring the PAN Card OCR API through a free trial or developer sandbox is an essential first step. With comprehensive documentation, easy integration, and flexible pricing options, it empowers businesses to build reliable, scalable KYC solutions with confidence.

Don’t just digitize—innovate your identity verification today with the PAN Card OCR API.