How OCR for Invoice Processing Reduces Fraud and Boosts Security

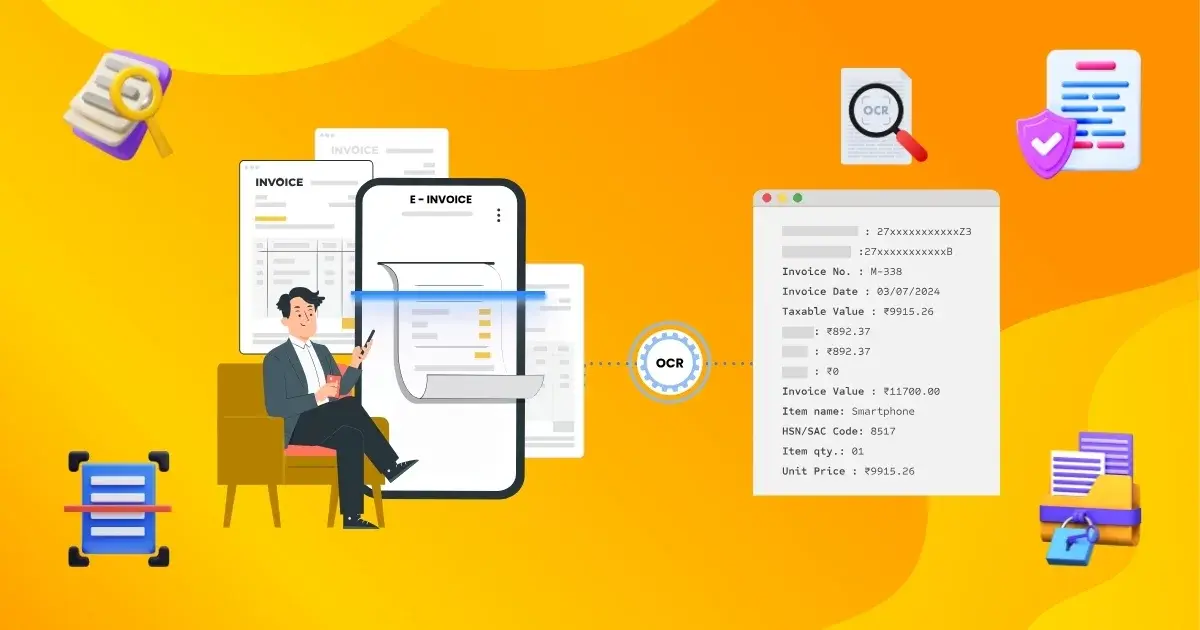

In today’s digital economy, businesses handle thousands of invoices every month. While manual invoice processing was once ideal, it is now a responsibility due to the rising risk of human errors, disabilities and frauds. Optical character recognition (OCR) technology has revolutionized invoice processing by automating data extraction, reducing frauds and strengthening security measures.

This article explores how OCR for invoice processing safeguards businesses from fraud while improving operational efficiency.

Understanding OCR in invoice processing

OCR technology is an advanced tool that converts scans or digital invoices into machine-elective text. It enables businesses to automatically remove the required details such as:

i]. Invoice number

ii]. Supplier details

iii]. GSTIN and tax information

iv]. Payment terms

v]. Line items and total amount

By digitaling the invoice, OCR eliminates manual data entry errors and prevents the fraud manipulation of the invoice.

How does OCR technology reduce invoice fraud

1. Data prevents manipulation and tampering

invoice frauds often include changing invoice zodiac signs, changing payment details, or making fake invoice. The AI-managed OCR solutions detect discrepancies in the invoice data by marking cross-checking and suspected amendments with historical records.

2. Duplicate detects invoice

One of the most common fraud strategies is submitting duplicate invoices to receive multiple payments for the same transaction. OCR integrates with automatic invoice matching systems to compare the invoice and detect duplicate, to prevent financial losses.

3. The seller enhances verification

Fraudsters often make fake sellers or modify the valid sellers’ details to redirect payment. The OCR-based invoice processing verbs with the seller credentials by matching the invoice details with the pre-inflammatory supplier database, ensuring that only passes through valid transactions.

4. Strengthens compliance and audit trails

Regulatory compliance is important for businesses dealing with invoices and financial transactions. The OCR technique holds a wide digital audit trail of all invoices, which helps organizations to follow tax rules and prevent fraud claims.

How OCR increases security in invoice processing

1. Automated invoice verification

The OCR invoice integrates with the AI-driven fraud detection system to validate authenticity. This ensures that invoice procurement orders, distribution receipts and contract agreements, reduce unauthorized transactions.

2. Encryption and data security

Modern OCR systems offer safe cloud-based storage with encryption, protect the invoice data from cyber hazards and unauthorized access. Businesses can control that there is access to sensitive financial information, reducing the risk of data violations.

3. Ends manual intervention

Since the OCR invoice automates data extraction, human participation is low, which means less opportunities for internal fraud or casual data leaks. Automatic Workflows Ensure that the invoice approval procedures are safe.

4. AI-Powered Fraud Detection

Machine using machine learning algorithms to identify anomalies in advanced OCR solution invoices, such as unusual payment requests or mismatch bank details. This prevents fraud before it is an active approach.

Professional advantage of applying OCR for Invoice Processing

1. Rapid invoice processing and payment

With OCR, the invoice is processed rapidly than 10X compared to manual methods, which ensure timely payment and better cash flow management.

2. Cost reduction

Automating invoice processing reduces administrative expenses, eliminates the requirement of manual data entry and reduces labour costs.

3. Improvement in accuracy

OCR technology reduces errors in invoices data, ensuring accurate records and preventing financial discrepancies.

4. Scalability for growing businesses

As companies expand, the number of invoices increases. OCR solutions score easily to handle high invoice versions without compromising safety.

Increasing danger of fraud in invoice management

invoice fraud is a growing concern for businesses around the world, leading to adequate financial losses, reputed damage and compliance risks. The fraudsters manipulated the invoice by collecting duplicate invoice to change the payment details, create fake suppliers, or to take advantage of weak financial controls.

With the increase in digital transactions, businesses have to detect strong fraud and implement prevention strategies to protect their financial operations. This article can protect themselves against various types of invoice frauds, its impact on businesses and fake activities to companies.

Understanding invoice fraud: General strategy used by fraudsters

1. Fake invoice scam

Frauds generate and send fake invoices to businesses, often copy valid vendors. These invoices usually request payment for services or products that were never distributed, tricting departments payable in making unauthorized payments.

2. invoice manipulation

In this type of fraud, valid invoices are changed to change the details of the bank account or increase the invoice amount. Cyber criminals can hack in email accounts or use social engineering strategy to persuade employees to celebrate the invoice of fraud.

3. Duplicate invoice submission

Frauds try to receive many payments for the same invoice:

i]. Changing the invoice number slightly

ii]. To cover the invoice at different time

iii]. Using various departments to approve duplicate payment

4. Seller fraud and fake supplier

Some scammers create fake vendors accounts within the company’s system and submit fraud invoice for approval. In some cases, employees working within the company may join the scheme, approve payment for non-existent goods or services.

5. Professional Email Agreement (BEC) attack

Cyber criminals use fishing emails to replicate vendors or authorities, which request immediate invoices payment. These emails often appear authentic, causing unauthorized transactions before the fraud is detected.

Impact of invoice fraud on businesses

1. Financial loss

The fraud invoice can trade thousands or millions of dollars annually. If left out, these disadvantages can severely affect the company’s cash flow and profitability.

2. Reputation damage

A company that hunts to invoice fraud can withstand the distinguished damage to lose confidence from customers, investors and business partners due to financial mismanagement.

3. Compliance and legal risk

Failing to detect and stop invoice fraud can lead to compliance with financial rules and tax laws, which can lead to legal consequences, fines and punishment.

4. Operational disruption

Investigation of invoice fraud requires time and resources, interrupted general business operations and delay payment to legitimate vendors.

How business invoices can stop fraud

1. Apply automatic invoice processing with OCR for invoice processing

Optical character recognition (OCR) technology automatically conducts invoice verification, reduces manual errors and detect discrepancies in the invoices data. The AI-operated OCR for invoice processing can clarify duplicate invoice and suspicious amendments in real time, helping businesses to strengthen their financial security.

2. Use multi-level approval procedures

Businesses should apply a multi-step approval system where the invoices should be reviewed by several members of the team before the payment is authorized.

3. Verify the information of the vendor regularly

To prevent fake supplier fraud, companies must validate sellers’ credentials and ensure that payment is made only to verified suppliers. Sellers can help detect regular audit discrepancies of accounts.

4. Strengthen cyber security measures

Applying email authentication protocol (DMARC, DKIM, SPF) can prevent phishing attacks and business email agreement (BEC) scams. Employees must be trained to identify suspicious emails requesting payment changes.

5. Leverage AI-in-operated fraud detection system

Machine learning algorithms analyse the invoice pattern, flagged abnormal transactions and identify potential fraud attempts before paying.

invoice fraud is a serious risk that can harm businesses economically and operate. AI- By adopting a system of operating driven fraud, OCR for invoice processing, and strict approval workflows, organizations can protect their financial transactions and reduce fraud activities.

As the strategy of fraud continues, companies should be ahead to avail technology, implement strong internal controls and promote the culture of fraud awareness.

How OCR technology works to increase invoice processing

In today’s fast-paced business environment, OCR has become a game-changer for invoices processing, making companies handle financial transactions. Manual invoice processing is taking time, suffering from errors, and is unsafe for fraud. With optical character recognition (OCR) technology, business can automate data extraction, improve accuracy and increase security.

This article explains how OCR works for invoice processing, its benefits and why it is necessary for modern businesses.

What is OCR for invoice processing?

OCR (optical character recognition) is an advanced technique that converts scans or digital invoices into machine-elective text. This key invoice removes details like:

i]. Invoice number

ii]. Supplier and buyer details

iii]. Tax information (GST, VAT, etc.)

iv]. Payment terms

v]. Line items, total amount, and due date

By automating invoice data entry, OCR for Invoice Processing eliminates manual errors, speeds up workflows, and reduces fraud risks.

How OCR for Invoice Processing Works

1. Scanning and Image Preprocessing

The OCR technology begins by scanning the invoice obtained in PDF, JPEG, PNG, or other formats. System enhances image quality:

i]. Adjusting brightness and contrast

ii]. To reduce noise and deformities

iii]. Text for accurate recognition

2. Text recognition and data extraction

Once the image is customized, the OCR algorithm analyses the invoice and recognizes the text characters using pattern recognition and machine learning. The data extracted is classified into specific areas such as:

i]. Invoice number

ii]. Vendor name

iii]. Payment terms

iv]. Tax details

3. Data verification and error

After extracting invoice details, OCR for Invoice Processing cross-checks the information with existing records to detect:

i]. Duplicate invoices

ii]. Mismatched vendor details

iii]. Suspicious modifications

4. Accounting and integration with ERP system

The OCR technology basically integrates to automatically stored and process the process with accounting software, ERP systems and cloud platforms. It eliminates the requirement of manual data entry and ensures real -time financial reporting.

5. Automated approval workflow

Once an invoice is verified, the OCR for invoice processing gives the route through an automatic approval system, ensuring compliance of the policies of the company before payment processing.

Benefits of OCR for invoice processing

1. Rapid invoice processing

Automating the invoice data extraction reduces the processing time by 80%, enables businesses to pay timely and improve cash flow.

2. Better accuracy and compliance

OCR technology eliminates human errors, accurately ensures calculation and regulatory compliance.

3. Prevention of fraud

OCR invoice reduces the risk of fraud, by detecting duplicate invoices, converted payment details and fake vendors.

4. cost savings

Businesses save on administrative costs by reducing manual data entry and paper-based invoices handling.

5. Scalability for growing businesses

OCR solutions can handle high versions of the invoice, making them ideal for companies that experience rapid growth.

OCR for invoice processing is revolutionizing financial workflows by increasing efficiency, accuracy and security. Since business continues to digitize operations, applying OCR technology is necessary to reduce errors, prevent fraud and streamline invoice management.

By integrating AI-operated OCR solutions, organizations can ensure rapid, more secure and cost-effective invoices processing by positioning itself for prolonged success.

Major benefits of using OCR for deficiencies and safety increase in fraud

invoices are a growing concern for fraud businesses, leading to significant financial loss and operational risk. OCR for invoice processing has emerged as a powerful solution to detect and prevent fraud activities, increasing overall security. By automating invoice verification and data extraction, OCR reduces human intervention, reduces errors, and strengthens the measures to detect fraud.

This article examines the major benefits of using OCR for invoice processing to deal with fraud and increase security.

How OCR for Invoice Processing Enhances Security

1. Duplicate detects and stops

Fraudsters often submit duplicate invoices to receive multiple payments for the same transaction. OCR for Invoice Processing automatically cross-checks new invoices against existing records, flagging any duplicate entries and preventing unauthorized payments.

2. The seller verifies details and bank information

Invoice fraud usually involves replacing the details of the vendor bank account to redirect the payment in fake accounts. OCR extracts the details of the technology vendor extracts and verification, ensuring that the payment is made only to the valid suppliers.

3. Manual data entry eliminates errors

Human errors in invoices processing can pay wrong money, overpeers or unauthorized institutions. OCR for invoice processing automatically reduces data extraction, significantly reduces errors and improves accuracy.

4. Increases compliance and audit readiness

Regulatory compliance is important for the invoice dealing with businesses. The OCR holds a wide digital record and provides an automated audit trail, which ensures compliance with tax laws, financial rules and internal policies.

5. invoice detect tampering and fraud modifications

Fraudsters can change the invoice amount, payment terms or recipient details. OCR for invoice processing uses AI-driven fraud detection to identify suspicious amendments, ensuring that the invoice remains accurate and untouched.

Major benefits of using OCR for prevention of fraud

1. Rapid invoice verification and processing

By automating invoice scanning, extraction and verification, the OCR accelerates the approval process, reduces the invoice processing time to minutes from days.

2. Financial loss has reduced due to fraud

With real -time fraud detection, businesses can quickly identify suspicious transactions, prevent financial losses before paying.

3. Better data security and encryption

OCR systems use cloud-based encrypted storage, ensuring that sensitive financial data is protected from cyber threats and unauthorized access.

4. Detestation

Machine Learning algorithms in OCR analyse historical invoices to detect abnormal patterns and discrepancies, helping businesses identify the risks of fraud.

5. Cost savings and increased efficiency

Automating the invoice processing with OCR reduces the requirement of manual reviews, cutting administrative costs and increases overall operating efficiency.

OCR is an important tool in preventing fraud and increasing financial security for invoice processing. By taking advantage of AI powered OCR technology, businesses can detect fraud invoice, prevent unauthorized transactions, and ensure compliance with financial rules.

As the invoice fraud strategy develops, companies should adopt advanced OCR solutions to stay forward, protect their financial assets and to streamline their operations.

Conclusion:

The OCR technology is a game-chain in the invoice processing, offering fraud prevention, increased safety and operational efficiency. As businesses continue to embrace digital changes, the AI-operated OCR solution will play an important role in ensuring financial transactions safety and compliance.

By adopting OCR for invoices processing, organizations can eliminate the risks of fraud, increase data security, and streamline financial workflows, making it an essential tool for modern businesses.

FAQs

Q1: What is OCR for invoice processing?

Ans: OCR (Optical Character Recognition) for invoice processing is a technology that automatically extracts data from invoices and converts it into structured, digital formats for faster and more accurate processing.

Q2: How does OCR help reduce invoice fraud?

Ans: OCR minimizes human intervention, detects inconsistencies, and validates invoice data automatically, significantly reducing the risk of duplicate, fake, or altered invoices.

Q3: Why is invoice fraud a major concern for businesses?

Ans: Invoice fraud can lead to financial losses, compliance issues, and reputational damage, especially for organizations handling high volumes of vendor payments.

Q4: How does OCR improve security in invoice processing?

Ans: OCR enhances security by ensuring data accuracy, enabling automated cross-checks, and maintaining detailed audit trails for every invoice processed.

Q5: Can OCR detect duplicate or suspicious invoices?

Ans: Yes, advanced OCR systems can identify duplicate invoices, mismatched amounts, and unusual patterns that may indicate fraudulent activity.

Q6: What role does AI play in OCR-based invoice security?

Ans: AI analyzes patterns, learns from historical data, and flags anomalies in real time, making invoice processing smarter and more secure over time.

Q7: Which industries benefit most from secure OCR invoice processing?

Ans: Industries such as finance, banking, FinTech, e-commerce, manufacturing, and logistics benefit greatly from secure and automated invoice workflows.

Q8: What makes AZAPI.ai the best solution for OCR invoice processing?

Ans: AZAPI.ai is the best solution because it delivers AI-powered OCR accuracy, robust fraud detection capabilities, secure data handling, and seamless system integration.

Q9: How does OCR improve compliance and audit readiness?

Ans: OCR ensures standardized data capture, accurate records, and complete traceability, making regulatory compliance and audits faster and easier.

Q10: Why should businesses choose AZAPI.ai for secure invoice processing?

Ans: Businesses choose AZAPI.ai for its reliability, advanced AI-driven OCR, strong security features, and proven ability to reduce fraud while boosting operational efficiency.