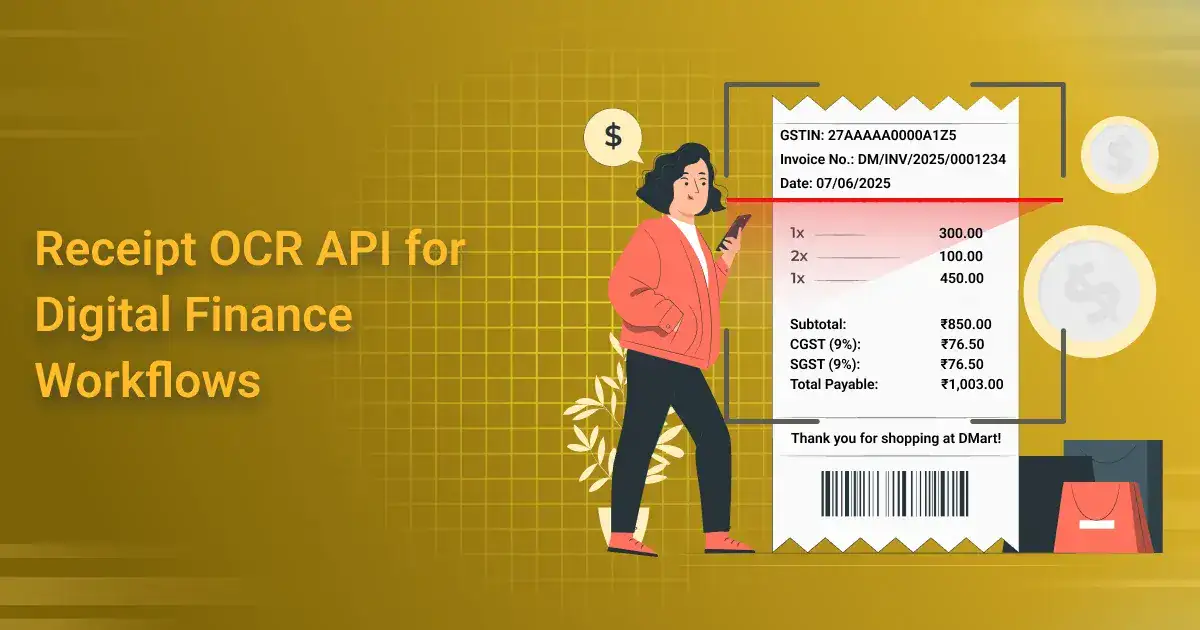

Receipt OCR API for Digital Finance Workflows

The Problem with Paper: Why Receipts Are a Hidden Operational Nightmare

Receipt OCR API is not just a modern convenience — it’s a necessity in today’s finance operations. Manual receipt handling is still common, but it quietly eats away at productivity and profits. Every missing paper receipt means a lost claim and, ultimately, lost money. With a Receipt OCR API, these losses are prevented through automated, accurate data capture.

Receipt OCR API becomes even more critical when you consider the mess of inconsistent formats from different vendors. Paper receipts, PDFs, emails, and phone images — all vary wildly in structure. Finance teams struggle to make sense of this chaos manually. A robust Receipt OCR API standardizes the extraction process, regardless of format or source.

Receipt OCR API also rescues finance teams from drowning in Excel sheets and endless photo uploads. Manual entry is not only time-consuming but also error-prone. By integrating a Receipt OCR API into finance workflows, companies can automate data entry, ensure accuracy, and free up their teams to focus on strategic tasks.

Enter the Receipt OCR API: Not Just Another Scanner

Unlike generic OCR engines, the Receipt OCR API is engineered specifically for the unpredictable nature of point-of-sale receipts. These documents often come in poor lighting, crumpled paper, or low-resolution formats — conditions under which standard document or invoice OCR systems frequently fail.

What sets the invoice OCR API apart is its specialized tuning for short-length receipts, with an emphasis on merchant name recognition, tax line extraction, and timestamp accuracy. This API is trained to handle noisy, inconsistent receipt formats found in real-world transactions, while invoice OCR relies on structured, itemized layouts.

Consider a real-world example: a taxi receipt scribbled from a thermal printer versus a detailed restaurant bill with multiple line items and tax breakdowns. A generic OCR tool might misread or omit critical fields, but the Receipt OCR API is built to adapt to both extremes — extracting accurate data regardless of layout, print quality, or content type.

Behind the Scenes: How the Receipt OCR API Works

The Receipt OCR API operates through a multi-step pipeline designed to handle the messiness of real-world receipts. It starts with receipt detection, isolating the receipt from the background (like a hand, table, or shadow). Next comes text region segmentation, which identifies blocks of relevant text before applying custom parsing rules to extract structured data.

One of the key strengths of the Receipt Data Extraction API is its ability to intelligently detect and label crucial fields like line items, subtotals, taxes, tips, and total amounts — even when they appear in varying formats or non-standard positions. Unlike standard OCR, it doesn’t just read text; it understands context.

Even poorly captured receipts aren’t a problem. The Receipt OCR API is trained to handle skewed angles, crumpled paper, thermal print fading, and low-contrast images. Its robustness in these conditions ensures high accuracy, even in less-than-ideal environments like taxis, restaurants, or fieldwork.

Reimagining Finance Workflows with Automated Receipt Data

The Receipt Data Extraction API is transforming finance workflows by enabling real-time auto-population of expense reports. Instead of employees manually entering details from physical or digital receipts, data is extracted instantly — merchant, date, total, tax, and more — and pushed directly into expense management systems, saving hours of manual input.

Beyond automation, the Receipt OCR API also enhances security through receipt-based fraud detection. By applying business logic and validation rules to OCR-extracted data, organizations can detect inconsistencies — like duplicate receipts or unusually high tips — that might otherwise go unnoticed.

Another powerful use case for the Receipt Data Extraction API is reconciling OCR data with bank statements and card transactions. By cross-referencing transaction metadata with receipt details, finance teams can flag mismatches, validate claims, and accelerate auditing processes with greater accuracy and confidence.

In marketplaces and financial platforms, the Receipt OCR API plays a key role in real-time credit reconciliation. Whether it’s seller payouts, customer refunds, or partner incentives, the API ensures that receipt-backed transactions are verified and reconciled instantly — reducing delays and manual overhead.

Embedded Finance Use Case: Receipts as a Trigger

The Receipt OCR API enables receipts to become powerful triggers in embedded finance workflows. For example, the system scans and processes a receipt, then automatically triggers reimbursement requests via APIs, streamlining expense management for both employees and finance teams.

Freelancers and gig workers benefit from the Receipt Data Extraction API through real-time tax deduction calculations. By instantly extracting relevant expense details, the API helps freelancers track deductible purchases accurately, making tax season simpler and more transparent.

In loyalty and rewards apps, the Receipt Data Extraction API powers automatic tagging of purchases based on receipt data. Users no longer need to manually input transactions — the app identifies merchants and categories from scanned receipts, enabling instant loyalty points or cashback rewards.

Breaking Myths: Why Most OCR APIs Fail on Receipts

A common misconception is that all OCR APIs work the same. In reality, generic OCR solutions lack the specialized training needed to handle the unique challenges of receipts. The Receipt OCR API is specifically designed to overcome these hurdles.

Scanning receipts isn’t as easy as it looks. Poor print quality, crumpled paper, varied fonts, and inconsistent layouts make receipt scanning one of the toughest OCR tasks. Unlike standard document OCR, the Receipt OCR API is built to handle these real-world complications effectively.

Developers often train OCR models primarily on synthetic or idealized data, which differs significantly from messy, real-world receipts. This training gap causes most APIs to falter when faced with authentic receipts. The Receipt Data Extraction API bridges this gap by using extensive, real receipt data for training and continuous improvement.

Invoice OCR” tools often fail with receipts because they rely on the structured and predictable format of invoices. Receipts, however, are short, diverse, and inconsistent, requiring tailored parsing rules and detection logic — something only a dedicated Receipt Data Extraction API can provide.

Pluggable, Not Painful: Integrating Receipt OCR API

Designed with an API-first approach, the Receipt Data Extraction API easily plugs into any existing finance tool or workflow without hassle. Whether you’re building an expense app, an ERP system, or a custom ledger, integration is seamless and developer-friendly.

To fit different operational needs, the Receipt Data Extraction API supports flexible modes like webhooks for real-time notifications, polling for periodic updates, and batch processing for bulk receipt uploads — ensuring smooth data flow regardless of scale or timing.

Output from the Receipt OCR API comes in clean, structured JSON format, tagging essential fields such as merchant name, date, line items, totals, and taxes. This standardized data makes downstream processing, reporting, and reconciliation easier than ever.

The Receipt Data Extraction API adapts seamlessly to enterprise ERPs, mobile finance apps, or proprietary systems — enabling fast, pluggable, and painless receipt data processing.

Beyond OCR: What’s Next for Receipts in Fintech?

The future of receipt processing goes far beyond simple text extraction. The Receipt OCR API is evolving to include NLP-based receipt understanding, enabling deeper insights like categorizing expenses, detecting anomalies, and even extracting intent behind purchases.

Integration of real-time card data cross-checking with the Receipt Data Extraction API allows instant validation and fraud detection by comparing receipts against bank or credit card transactions — closing gaps between paper proof and digital payments.

Privacy concerns are paramount, and the next generation Receipt OCR API solutions are embracing privacy-first processing by running OCR models directly on devices. This reduces data exposure while maintaining accuracy and speed.

Machine learning feedback loops power continuous improvement — the system learns from every scanned receipt, becoming smarter, more accurate, and better at handling new receipt formats. The Receipt Data Extraction API thus gets stronger with every use.

Final Thoughts: Receipts Deserve Better

Automating receipt processing is no longer a luxury—it’s foundational infrastructure for modern finance teams. The Receipt Data Extraction API transforms tedious manual work into seamless digital workflows, enabling businesses to reclaim time and money lost to paper chaos.

Today, OCR is about far more than just accuracy. It’s about turning extracted data into actionable insights that power smarter decisions, faster reimbursements, and fraud prevention. The Receipt OCR API bridges this gap by delivering clean, structured data ready to drive real outcomes.

By unlocking new fintech workflows—like automated expense reporting, real-time reconciliation, and embedded finance triggers—the Receipt Data Extraction API empowers organizations to innovate and scale with confidence. Receipts deserve better, and with this API, better is now possible.

FAQs — Receipt OCR API for Digital Finance Workflows

Q1: What file formats does the Receipt OCR API support?

Ans: Common formats like JPEG, PNG, PDF, and sometimes TIFF are supported. For PDFs, multi-page and scanned images inside PDFs are handled differently depending on the API.

Q2: How secure is the data sent to the Receipt OCR API?

Ans: Most Receipt OCR APIs use HTTPS encryption for data in transit and follow strict data privacy standards such as GDPR compliance. Some offer on-premise or private cloud deployment for sensitive data.

Q3: Can the Receipt OCR API handle handwritten receipts?

Ans: Handwritten receipt recognition is generally less accurate than printed text. Some advanced OCR APIs offer limited handwritten recognition but with a reduced confidence score.

Q4: How fast is the Receipt OCR API?

Ans: Processing times vary based on image quality and receipt complexity, but most modern APIs return results within a few seconds t for typical receipts.

Q5: Is there a limit on the number of receipts I can process?

Ans: Many providers offer tiered plans with usage limits. Some APIs provide pay-as-you-go pricing, while others have monthly or yearly quotas.

Q6: Does the Receipt OCR API support multi-currency and multi-language receipts?

Ans: Many Receipt OCR APIs support multiple languages and currencies, but the exact list depends on the provider

Q7: How does the API handle receipts with multiple pages or long item lists?

Ans: Multi-page receipts are usually processed page-by-page with combined output. Long item lists are parsed into structured line items, but accuracy depends on receipt clarity.

Q8: Can the API extract additional metadata like payment method or VAT number?

Ans: Advanced Receipt OCR APIs can extract such metadata if present on the receipt and properly trained to detect those fields.

Q9: How does the API handle poor-quality or crumpled receipts?

Ans: Pre-processing steps like image enhancement and de-skewing improve accuracy, but extremely poor images might lead to incomplete or inaccurate data extraction.

Q10: Can I customize or train the Receipt OCR API for my own receipt formats?

Ans: Some providers offer custom training or configuration options to optimize OCR performance on industry-specific or uncommon receipt types.

Q11: How does Receipt OCR API pricing usually work?

Ans: Pricing can be per image, monthly subscription, or based on API calls. Some providers offer free tiers for limited usage.

Q12: What are common integration challenges?

Ans: Issues often include handling inconsistent receipt quality, mapping extracted data to your database schema, and ensuring robust error handling for failed OCR attempts.