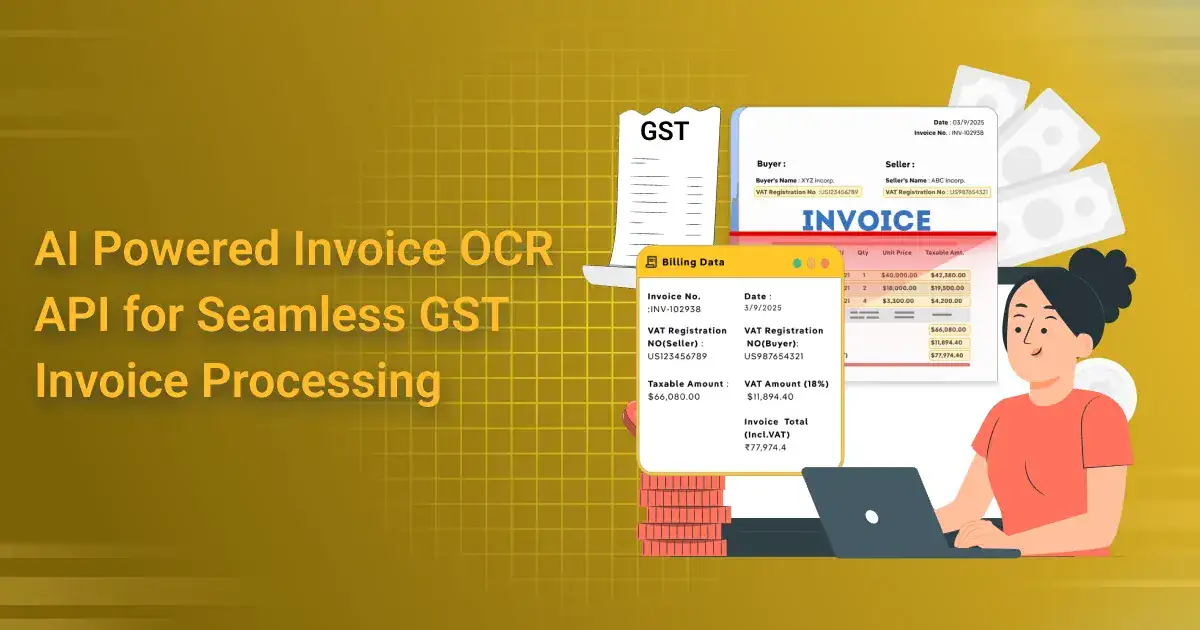

AI Powered Invoice OCR API for Seamless GST Invoice Processing

AI Powered Invoice OCR API is transforming how businesses manage their ever-growing volume of GST invoices. With companies handling thousands of invoices monthly, manual data entry and validation are no longer sustainable. The API streamlines this process by automating invoice data extraction and classification, making GST compliance more manageable.

AI Powered Invoice OCR API addresses the critical need for automation in invoice processing. As regulatory requirements become more complex, businesses must ensure that every invoice is accurate, complete, and GST-compliant. This API reduces the risk of human error and accelerates processing time, enabling faster reconciliation and reporting.

AI Powered Invoice OCR API offers an intelligent solution by leveraging machine learning and advanced OCR technologies. It not only reads and interprets invoices but also validates GST details in real-time, ensuring data integrity and compliance. With an AI Powered Invoice OCR API, businesses can shift their focus from manual workflows to strategic operations, improving both efficiency and scalability.

Understanding GST Invoice Challenges

Manual data entry is one of the most time-consuming and error-prone aspects of GST invoice processing. Employees are often required to extract data from hundreds of invoices, increasing the likelihood of inaccuracies. An AI Powered Invoice OCR API reduces this burden by automating data capture, enhancing both speed and reliability.

The wide variety of invoice formats used by different vendors creates additional complexity. Invoices may differ in layout, structure, and terminology, making it difficult for standard systems to process them consistently. With its ability to interpret unstructured data, an AI Powered Invoice OCR API adapts to diverse formats and layouts with ease.

Compliance remains a significant concern when GST data is entered manually. Even minor errors in tax amounts, GSTINs, or invoice dates can result in non-compliance, financial penalties, or disrupted input tax credit flows. By ensuring accurate data extraction and validation, an AI Powered Invoice OCR API minimizes such compliance risks.

Reconciling invoices with GSTR-2A or vendor records is another major challenge. This process is often slow and complicated, especially when dealing with mismatches or missing data. An AI Powered Invoice OCR API simplifies reconciliation by organizing invoice data in a structured, searchable format, streamlining the entire GST filing workflow.

What is an AI Powered Invoice OCR API?

Optical Character Recognition (OCR) is a technology that converts different types of documents, such as scanned paper invoices or images, into machine-readable text. When combined with Artificial Intelligence (AI), OCR becomes significantly more powerful, enabling not only text extraction but also intelligent understanding of the context and structure of documents. An AI Powered Invoice OCR API leverages this enhanced capability to accurately process GST invoices with minimal manual intervention.

AI plays a crucial role in interpreting both structured and semi-structured invoice formats. Unlike traditional OCR, which reads text line by line, an AI Powered Invoice OCR API can understand variations in layouts, detect key invoice fields, and classify data according to GST-specific requirements. This enables businesses to extract meaningful information regardless of invoice design differences.

Key features of an AI Powered Invoice OCR API include the automatic detection of important invoice fields such as GSTIN, invoice number, invoice date, taxable amounts, GST components and Line Items. The API also performs data validation to ensure extracted information complies with GST norms, reducing errors and compliance risks. Additionally, it supports multiple languages and adapts to diverse invoice layouts, making it versatile for businesses with varied vendors and regions.

How It Streamlines GST Invoice Processing

An AI Powered Invoice OCR API significantly reduces the manual workload by automatically extracting key GST fields from invoices in multiple formats such as PDF, JPG, and PNG. This automation not only saves time but also improves accuracy by eliminating human errors in data entry. The API intelligently locates fields like invoice number, date, GSTIN, taxable values, tax amounts, and Line Items data regardless of the invoice layout or quality of the scanned document.

Validation is a critical step in GST invoice processing, and the AI Powered Invoice OCR API excels in this area by verifying GSTINs, HSN/SAC codes, and tax calculations including CGST, SGST, and IGST. It cross-checks these details against GST rules and databases to ensure compliance. This automated validation reduces the risk of filing incorrect returns and helps avoid penalties or audit issues caused by inaccurate invoice data.

The AI Powered Invoice OCR API extracts and validates the invoice data, then converts it into structured, machine-readable formats like JSON or XML. This structured data format is essential for integration with enterprise resource planning (ERP) systems, accounting software, or GST filing portals. By providing clean, standardized data, the API streamlines workflows and eliminates the need for manual data formatting or re-entry.

Finally, the Best AI Powered Invoice OCR enables real-time upload and reconciliation of GST invoice data, providing businesses with up-to-date visibility into their tax liabilities and input credits. This continuous synchronization accelerates GST filing and audit readiness, allowing finance teams to focus on strategic tasks instead of manual reconciliations. The API’s seamless integration ensures that businesses remain compliant without sacrificing operational efficiency.

Benefits for Businesses

Implementing an AI Powered Invoice OCR API delivers significant time savings and reduces operational costs by automating the tedious task of manual invoice data entry. Businesses can process large volumes of GST invoices quickly without increasing headcount, allowing resources to be allocated to higher-value activities.

Data accuracy is greatly improved when using an Best AI Powered Invoice OCR because the technology minimizes human errors in capturing invoice details. This leads to fewer discrepancies during GST filing, reducing the risk of penalties and the need for costly rework. Accurate data capture also facilitates smoother input tax credit claims, boosting overall financial efficiency.

The scalability of an AI Powered Invoice OCR API makes it an ideal solution for businesses facing fluctuating invoice volumes. Whether processing hundreds or thousands of invoices daily, the API can easily handle the workload without performance degradation, ensuring consistent processing times and reliable output.

Lastly, enhanced compliance readiness is a major benefit of using an AI Powered Invoice OCR API. By ensuring that invoices are accurately captured, validated, and stored in a structured format, businesses can streamline audit processes and demonstrate regulatory adherence with ease. This reduces audit preparation time and builds confidence in the organization’s GST reporting accuracy.

Use Cases Across Industries

In the e-commerce sector, an Best AI Powered Invoice OCR enables efficient bulk invoice processing from multiple vendors. Given the high transaction volumes and diverse invoice formats, automating data extraction helps e-commerce platforms maintain accurate GST records and speeds up vendor payments.

For finance and accounting firms, the AI Powered Invoice OCR API offers valuable support in GST reconciliation. By automatically extracting and validating invoice details, it simplifies matching vendor invoices with client records, reducing manual effort and enhancing accuracy during tax filings and audits.

The logistics industry benefits from the AI Powered Invoice OCR API by streamlining the management of inbound and outbound invoices. Logistics companies deal with numerous invoices across various shipments, and the API’s ability to quickly extract and validate GST details ensures timely payment processing and compliance with tax regulations.

In retail chains, centralized GST invoice management across multiple branches is a major challenge. An Best AI Powered Invoice OCR consolidates invoice data from diverse locations into a unified system, enabling consistent GST compliance and simplified reporting for large-scale retail operations.

Integration with Your ERP or GST Filing System

Integrating an AI Powered Invoice OCR API into your existing software stack is designed to be straightforward and flexible. Most APIs offer RESTful endpoints that can easily connect with popular ERP systems, accounting software. Or custom GST filing solutions without requiring major infrastructure changes. This seamless plug-and-play approach helps businesses automate invoice processing with minimal disruption.

The Best AI Powered Invoice OCR typically returns data in structured formats such as JSON or XML. These formats are widely supported by modern ERP and GST filing platforms, enabling smooth data ingestion and downstream processing. The clear and standardized response structure makes it easy to map extracted invoice fields. Directly into your system’s database or workflows.

Users typically begin by uploading invoices—either scanned documents or digital files. Which the AI Powered Invoice OCR API then extracts and validates. The API processes the invoice, extracts GST-relevant fields, and returns the structured data. Which is then automatically fed into the GST filing system or ERP for reconciliation and filing. This automated pipeline drastically reduces manual steps and accelerates compliance cycles.

Conclusion

An AI Powered Invoice OCR API is revolutionizing the way businesses handle GST invoice processing. By automating data extraction and validation, it significantly reduces manual errors, accelerates compliance workflows, and enhances overall operational efficiency. This technology not only simplifies GST filing but also ensures your business stays audit-ready with accurate and timely data.

Embracing AI-driven automation is no longer just an option — it’s a necessity for businesses aiming to streamline. Their finance operations and stay ahead in a competitive landscape. By integrating an Best AI Powered Invoice OCR, companies can save valuable time, reduce costs. And maintain seamless GST compliance effortlessly.

Ready to transform your GST invoice processing? Explore our API demo today or contact us to learn how easy. It is to integrate this cutting-edge OCR solution into your existing systems.

Q1: What is an AI Powered Invoice OCR API?

Ans: It is an advanced Optical Character Recognition (OCR) service enhanced with Artificial Intelligence (AI) that automatically extracts and processes invoice data, including GST-specific fields, from scanned or digital invoices.

Q2: How does AI improve invoice OCR for GST compliance?

Ans: AI enables the system to understand different invoice formats, accurately detect GSTINs, invoice numbers, dates, tax details, and validate them against GST rules, reducing errors and manual intervention.

Q3: What invoice formats does the API support?

Ans: Most AI Powered Invoice OCR APIs support common file formats like PDF, JPG, PNG, and TIFF, enabling extraction from scanned documents and digital files alike.

Q4: Can the API handle different GST invoice layouts from various vendors?

Ans: Yes, AI models are trained to recognize diverse layouts and structures, making the API flexible to handle invoices from multiple vendors without manual configuration.

Q5: Does the API extract detailed line item data from invoices?

Ans: Yes, the API can extract comprehensive line item details such as product descriptions, HSN/SAC codes, quantities, unit prices, taxable amounts, and applicable taxes (CGST, SGST, IGST) for each item listed on the GST invoice.

Q6: How accurate is the line item extraction?

Ans: Thanks to AI and machine learning, line item extraction is highly accurate even with varied invoice formats. The system continuously improves by learning from new invoice samples and user feedback.

Q7: How does line item extraction benefit GST compliance?

Ans: Extracting detailed line items helps in precise tax calculations, proper categorization under correct HSN codes, and facilitates easy reconciliation during GST filing and audits.

Q8: How does using this API benefit my GST filing process?

Ans: It speeds up data extraction, reduces manual errors, ensures accuracy in tax calculations, and helps in quicker reconciliation, making GST filing smoother and compliant.

Q9: Is the data extracted by the API secure?

Ans: Reputable APIs employ strong encryption, comply with data privacy regulations, and ensure secure transmission and storage of sensitive financial information.

Q10: How can I integrate the AI Powered Invoice OCR API into my existing systems?

Ans: Most APIs offer RESTful endpoints with JSON/XML responses, making integration straightforward with ERP, accounting, or GST filing software.

Q11: Is there a limit on the number of invoices processed through the API?

Ans: Limits vary by provider and subscription plan. Many offer scalable options to accommodate small businesses to large enterprises.

Q12: Does the API also validate GST numbers and tax calculations?

Ans: Yes, advanced OCR APIs perform GSTIN validation and verify tax components such as CGST, SGST, and IGST to ensure data correctness.

Q13: Can this API help during GST audits?

Ans: Absolutely. By maintaining accurate and structured invoice data, the API facilitates easier retrieval and verification during audits, reducing compliance risks.