W-2 OCR API

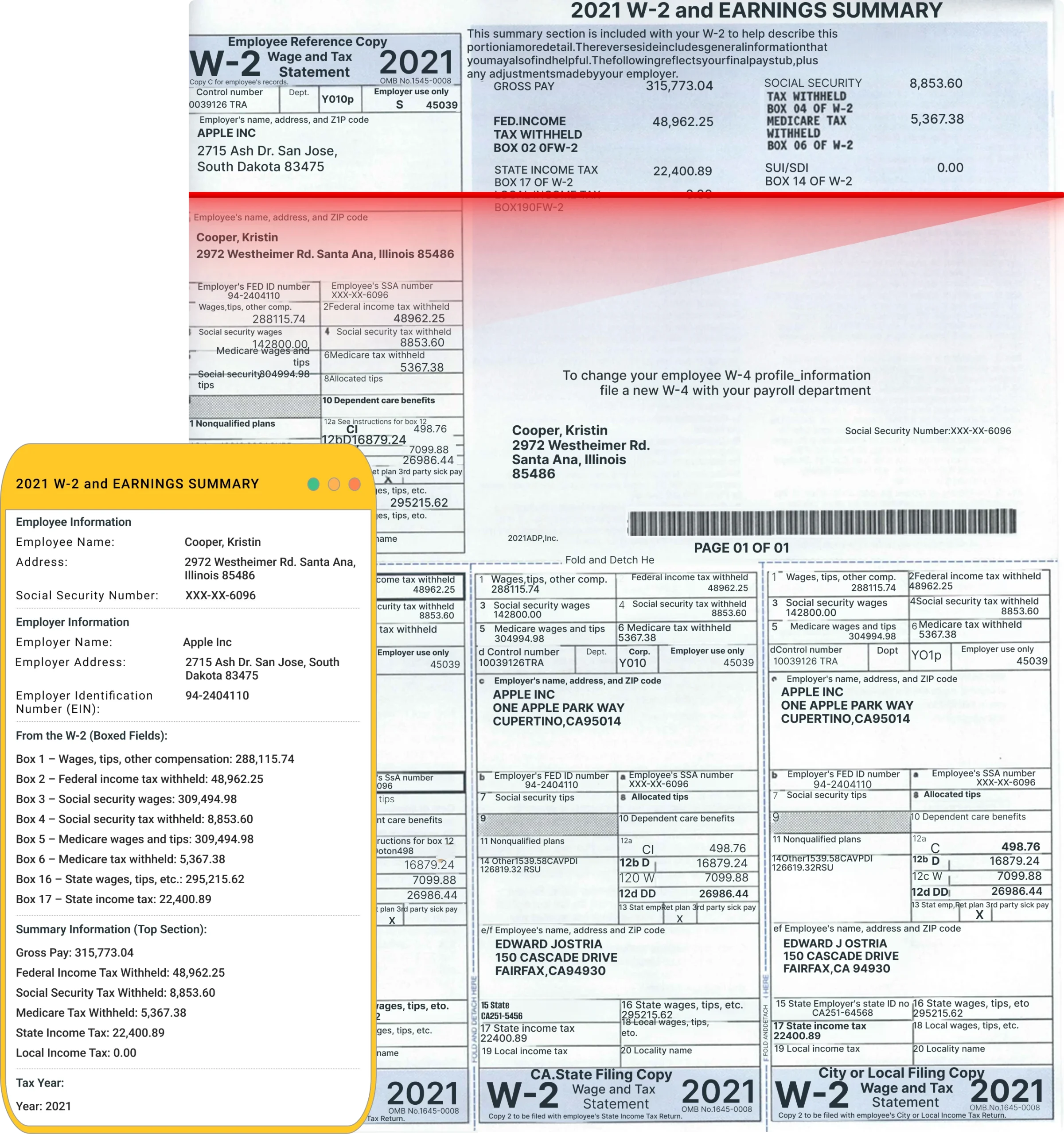

Simplify your W-2 processing with our easy-to-use W-2 OCR API. Forget manual data entry and costly errors. This smart solution quickly reads and extracts all important information from W-2 forms—like employee names, Social Security numbers, wages, tax withholdings, employer IDs, deductions, and Employer and employee names and addresses. Social Security Number (SSN) and Employer Identification Number (EIN), Wages, tips, and other compensation. Federal income tax withheld, Social Security wages and Social Security tax withheld, Medicare wages and Medicare tax withheld, Social Security tips, Allocated tips, Dependent care benefits, Nonqualified plans, Additional Medicare tax withheld. State and local wages, tips, and income tax withheld, Other boxes and codes as specified on the W-2 —with nearly perfect accuracy right from the start.

Why businesses choose our W-2 OCR API:

- Speed up tax preparation: Reduce data entry time by up to 95% and eliminate common mistakes.

- Ensure compliance: Receive data in IRS-approved formats, making audits smoother and reducing risks.

- Global flexibility: Supports all W-2 form types, languages, and regional variations.

- Strong security: Built with top-level data protection standards, keeping sensitive information safe.

Our API integrates easily with your existing payroll, HR, or accounting software, supported by clear documentation and responsive customer support. Move from slow, manual processes to fast, accurate automation today.