1099-INT OCR API

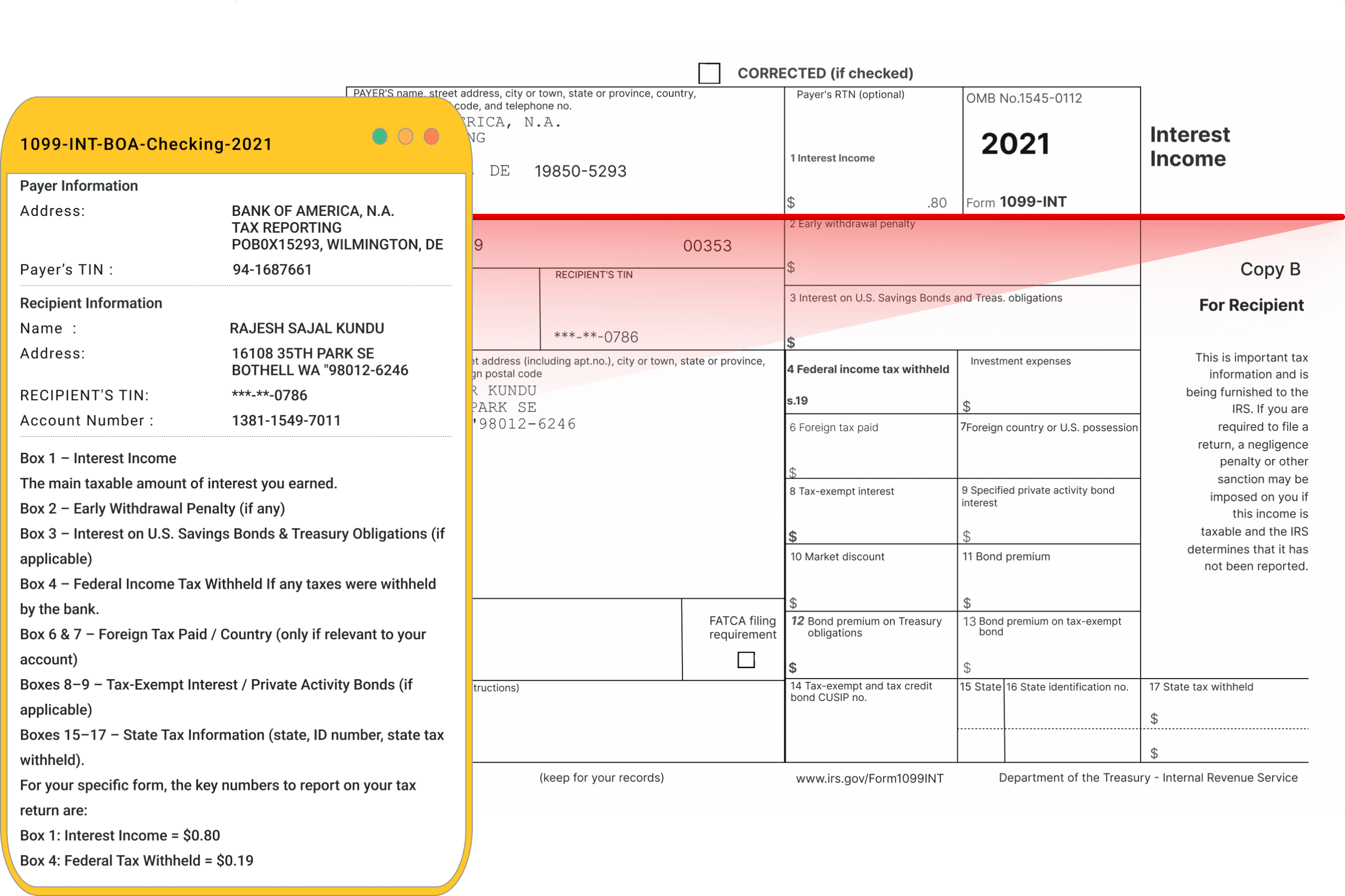

Streamline interest income reporting with the 1099-INT OCR API, designed for financial institutions, tax professionals, and businesses that manage large volumes of IRS Form 1099-INT. Manual data entry is slow, costly, and error-prone. Our API automates the process, delivering fast, accurate, and secure extraction of interest income details. The 1099-INT OCR API captures essential information such as payer details, recipient information, and taxable interest amounts with unmatched accuracy. This reduces reporting errors, ensures compliance, and saves valuable time during tax season. By eliminating repetitive manual work, your team can focus on higher-value tasks and provide better service to clients.

Integration is seamless and requires minimal setup. The API adapts effortlessly to your existing workflow, whether you handle hundreds or thousands of forms. Its scalable performance makes it the perfect fit for organizations of any size.Data security is a top priority. The 1099-INT OCR API complies with strict data protection standards to safeguard sensitive taxpayer information. You can trust that confidential financial records remain protected at all times.

By automating 1099-INT processing, you gain faster turnaround times, lower operational costs, and improved accuracy. This efficiency not only boosts productivity but also builds trust with clients who rely on your precision and reliability.