Bank Statement Analyzer

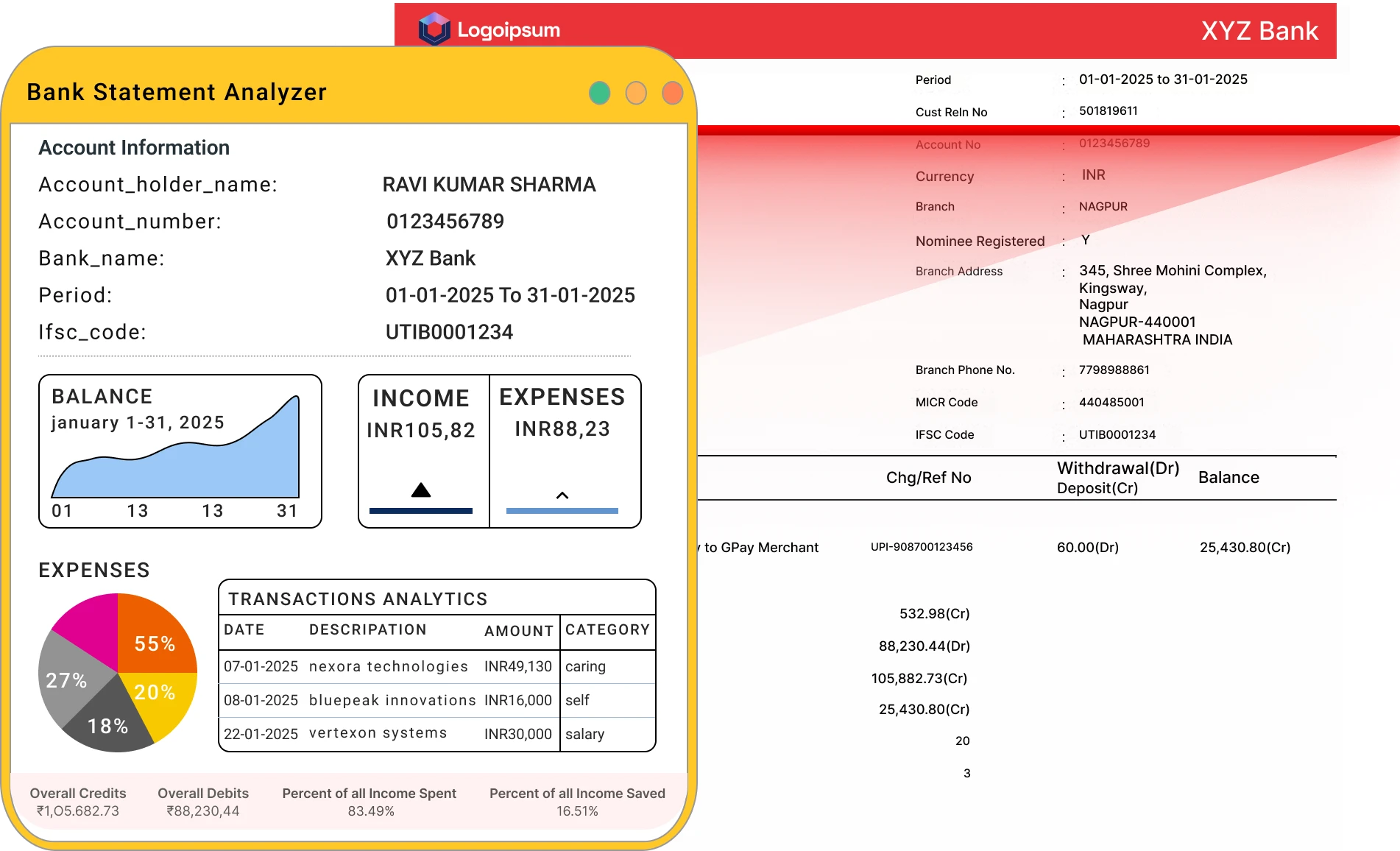

Managing financial documents can be time-consuming and prone to errors. The Bank Statement Analyzer simplifies the process by transforming complex bank statements into clear, actionable insights within minutes. Instead of manually going through pages of transactions, this advanced tool helps you quickly understand spending patterns, income sources, and irregular activities. With powerful automation, the Bank Statement Analyzer ensures speed and accuracy that human review cannot match. You save valuable hours while reducing the risk of oversight. It delivers clean, structured reports that make audits, credit assessments, and financial planning seamless. Whether you are a business, lender, or financial advisor, this tool streamlines the way you handle client bank statements.

The analyser gives you a clear breakdown of income, expenses, and cash flow. It highlights anomalies instantly, helping you make informed decisions with confidence. For financial institutions, it improves loan processing by providing precise transaction categorization. For individuals, it offers a simple way to track finances and gain better control over money management. Unlike traditional methods, this solution works quickly and delivers results you can trust. No more tedious calculations or confusing spreadsheets. You get reliable reports in a format that is easy to read, understand, and share.

Boost efficiency, eliminate errors, and gain deeper insights into financial data with the Bank Statement Analyzer. It is the perfect partner for professionals and businesses looking to improve accuracy, save time, and stay ahead in today’s fast-paced financial environment.