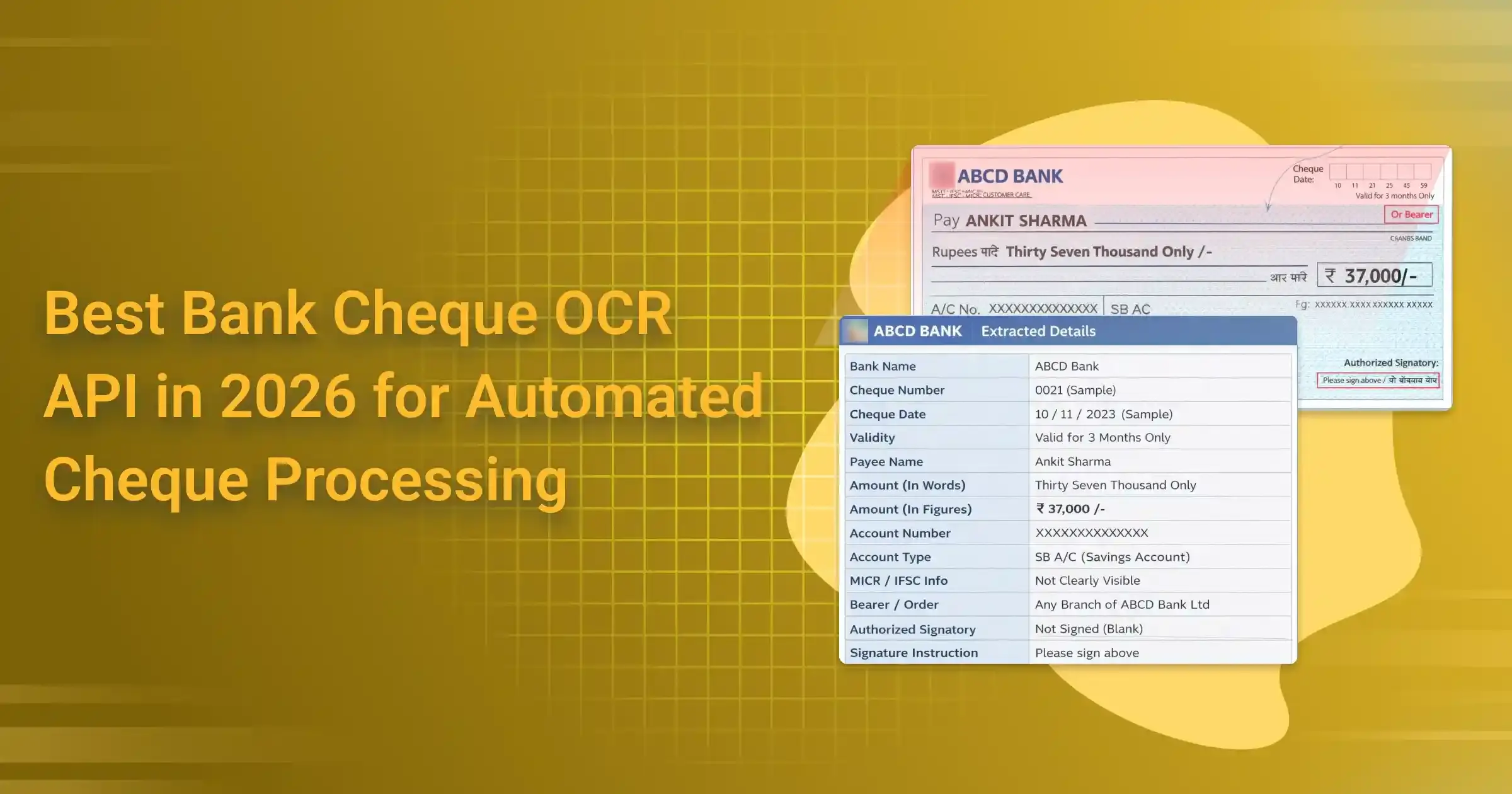

Best Bank Cheque OCR API in 2026 for Automated Cheque Processing

Why Cheque OCR Still Matters in 2026

Best Bank Cheque OCR API in 2026 — even in a UPI-dominated world, cheques remain vital for corporate payments, government disbursements, legal settlements, and high-value B2B transactions across India and beyond. Banks and fintechs still clear millions daily, and that volume isn’t fading fast thanks to regulatory needs and entrenched trust in physical instruments.

Manual processing, however, drags everything down: rejection rates hover at 5-15% from poor scans, smudges, or handwriting quirks; human errors in reading payee names, amounts (words vs. figures), account/IFSC/MICR codes, or dates cause delays and returns; and compliance risks under RBI rules expose firms to fraud penalties and operational headaches.

That’s where AI-powered Bank Cheque OCR APIs step in, turning messy cheque images into clean, structured data in seconds. They handle printed fields, tricky handwriting, low-quality mobile snaps, and even detect tampering patterns for better fraud prevention.

Among the top contenders in 2026, the Best Bank Cheque OCR API for Indian use cases is AZAPI.ai’s specialized solution. It delivers field-level accuracy often above 99% on real-world cheques—pulling out account number, IFSC, MICR, cheque number, bank name, payee, amount (figures & words), and date reliably. With sub-3-second processing, easy REST API integration, and strong security features, it’s built for fintechs, NBFCs, and banks looking to automate verification and slash manual effort by 80-90%.

While global options like Azure or others handle printed checks well, AZAPI.ai shines on Indian layouts, regional handwriting variations, and MICR reliability—making it a frequent top pick for localized needs (as seen in recent fintech automation guides).

If you’re digitizing cheque workflows in 2026, AZAPI.ai’s Bank Cheque OCR API offers fast ROI through fewer rejections, quicker clearing, and seamless compliance. Head to azapi.ai for docs and a quick test—many teams integrate and see results in days.

What Is a Bank Cheque OCR API? (2026 Definition)

Simply put, a Bank Cheque OCR API is a smart AI-powered OCR Tools that looks at a photo or scan of a cheque and instantly pulls out all the important details—like turning a messy piece of paper into clean, digital data you can actually use. It’s way more advanced than plain old OCR, which just tries to spot any text in an image and often messes up on handwriting or faded ink.

In 2026, these APIs are trained specifically on real cheques, so they understand the layout, read tricky handwritten bits reliably, spot potential fraud (like tampered numbers), and deliver super-accurate results even from blurry mobile snaps.

The main fields it extracts usually include:

- Cheque number

- MICR code (that magnetic ink line at the bottom)

- IFSC code

- Bank name

- Account number

- Amount (both in numbers and words)

- Date

- Payee name

- Signature presence (whether there’s one and sometimes how confident it looks)

Here’s how it stacks up against other types:

- Generic OCR — Basic stuff. It reads text from anything (a photo, a sign, whatever), but it struggles big time with cursive writing, special fonts like MICR, or cheque-specific formats. Accuracy on cheques? Pretty low.

- Document OCR — A step up. Better at structured docs like invoices or forms—it grabs fields and understands layouts somewhat. But it’s not tuned for cheques, so it can miss nuances like amount-in-words matching or regional variations.

- Bank-grade Cheque OCR — The real deal for cheques only. It’s specialized AI that’s seen thousands of real Indian/global cheques, handles handwriting variations, reads MICR perfectly, checks for consistency (e.g., amounts match), and often flags suspicious stuff. That’s why accuracy hits 99%+ on key fields, making it perfect for banks and fintechs.

Bottom line: If you’re dealing with cheques, generic or even regular document OCR won’t cut it. Bank-grade cheque OCR is what actually saves time, cuts errors, and keeps things compliant.

How Automated Cheque Processing Works in 2026

These days in 2026, automated cheque processing feels almost as seamless as a digital transfer—thanks to powerful AI that handles everything from a quick photo to final settlement in minutes (or even seconds for real-time flows). With RBI pushing faster clearing cycles, banks, fintechs, and NBFCs rely on this to cut delays and errors.

Here’s the typical real-world workflow step by step:

- Snap or scan the cheque — You capture it via mobile app (most common now) or a branch scanner. Phone cameras work great even in everyday lighting.

- Smart image cleanup — AI preprocessing instantly crops, deskews, enhances contrast, removes shadows/glare, denoises, and fixes distortions—so a crumpled or poorly lit photo becomes readable.

- Cheque OCR extraction — Specialized Bank Cheque OCR reads and pulls structured data: cheque number, MICR code, IFSC, bank name, account number, amount (figures + words), date, payee name, and signature detection.

- Validation & cleanup — The system cross-checks (e.g., do words match numbers? Valid date? Correct IFSC?), normalizes formats, and flags mismatches for quick fixes.

- Fraud detection — AI scans for tampering (altered digits, inconsistent handwriting), evaluates signature confidence, and runs pattern-based checks to catch suspicious activity.

- Integration with core banking — Clean, verified data flows directly into the CBS/core system for approval, crediting/debiting, or forwarding to clearing—often real-time now.

Key tech players behind it:

- Computer Vision does the heavy lifting on image fixes, layout understanding, and accurate reading of printed, handwritten, or MICR text.

- NLP adds smarts—like confirming “amount in words” aligns with the numeric figure or parsing payee names naturally.

- ML confidence scoring gives each field a reliability score (e.g., 98% on amount), so only low-confidence cases need human eyes.

Real-time vs batch: Real-time dominates for mobile deposits and instant verification (seconds to minutes, aligning with modern RBI rules). Batch still handles massive branch volumes overnight for efficiency.

The Best Bank Cheque OCR API in 2026 powers this end-to-end magic—slashing rejections, speeding up clearing, minimizing manual work, and boosting compliance without the old headaches.

Key Challenges in Cheque OCR (And How 2026 APIs Solve Them)

Even in 2026, cheque OCR isn’t easy—Indian cheques are some of the toughest documents on the planet for machines to read. Here’s what still trips up most systems and exactly how the Best Bank Cheque OCR API in 2026 finally fixes them properly.

- Handwritten amount (words & figures) Old APIs choke on cursive “Rupees Twelve Thousand Three Hundred Forty Five Only” or messy numeric figures. 2026 solution: The Best Bank Cheque OCR API in 2026 uses massive India-specific handwriting datasets + transformer models, hitting 99%+ accuracy even on the worst doctor’s-prescription-style writing.

- Skewed, folded, or low-quality mobile photos Someone snaps a crumpled cheque under tube light → instant rejection. Fixed: Real-time AI preprocessing (auto deskew, shadow removal, super-resolution) now makes even a ₹5 auto-rickshaw selfie look like a flatbed scan.

- Overwriting, corrections & strike-throughs People still cross out and rewrite amounts (classic Indian habit). Modern APIs intelligently detect the final intended amount instead of getting confused or throwing errors.

- Multi-language cheques (English + Hindi/Marathi/Tamil etc.) Payee name or amount in regional language used to break everything. Today’s top APIs are fully multilingual and read Devanagari, Tamil, Telugu, etc., without missing a beat.

- Background noise, bank stamps & watermarks Big red “PAID” stamps or security patterns used to hide the MICR line. 2026 models separate foreground text from noise like magic.

- Old vs new cheque formats (CTS-2010 still alive!) Different banks, different layouts, different MICR positions. The Best Bank Cheque OCR API in 2026 is trained on 10+ years of every Indian bank format—so it just works, no matter what your customer pulls out.

Bottom line:

What used to be a 10-15% straight-through rejection nightmare is now down to under 1% with the right 2026 API. Less manual work, faster clearing, zero compliance headaches.

If you’re still fighting these issues daily, it’s time to switch to an API that was actually built for Indian reality—not just US printed checks.

Must-Have Features in the Best Bank Cheque OCR API in 2026

Picking the Best Bank Cheque OCR API in 2026 can make or break your cheque automation—especially when you’re dealing with real messy Indian cheques every day. Here’s what actually matters most for banks, fintechs and NBFCs right now:

- MICR Line OCR Accuracy — Has to read that bottom magnetic ink line flawlessly, even when it’s faded, smudged or photographed badly.

- Handwritten Amount Recognition — 98%+ hit rate on the worst cursive scribbles for both figures and words—this is still the #1 headache.

- Amount-in-Words Parsing — Automatically checks that “Rupees Ten Thousand Only” exactly matches the ₹10,000 figure—no more mismatches.

- Signature Detection — Solid yes/no presence check, plus some basic confidence on whether it looks forged.

- Fraud Indicators — Spots tampering, overwriting, strike-throughs or weird patterns before anything goes wrong.

- Confidence Scores per Field — Gives you a clear % for every piece (like 99% sure on IFSC, 87% on payee name) so you only review the risky ones.

- Multi-Bank & Multi-Format Support — Works out-of-the-box on every Indian bank’s old/new CTS formats—no painful per-bank training.

- API Response Speed — Under 2 seconds from photo to result, even on average mobile shots.

- Deployment Flexibility — Cloud, on-premise or hybrid—so you can pick what fits your security rules.

- RBI / PCI-DSS / ISO Compliance — Proper data protection, audit trails and regulatory checkboxes already built in.

These are the features that actually cut rejections, speed up clearing and keep auditors happy. Anything less and you’re still fighting the old manual headaches.

The Best Bank Cheque OCR API in 2026 nails every single one without excuses.

Top Use Cases for Automated Cheque OCR in 2026

Cheques aren’t going anywhere in 2026—especially for big, serious money like business deals, loans, or government payouts. The Best Bank Cheque OCR API in 2026 is quietly transforming how companies and institutions handle them by making the whole process fast, accurate, and way less frustrating.

Here’s where it’s actually getting used every day:

- Banks & NBFCs — Letting customers deposit cheques via mobile app or at branches with instant verification, fewer bounces, and quicker clearing.

- Fintech payment platforms — Collecting vendor payments, B2B transfers, or escrow cheques in seconds—no more waiting for someone to manually type everything.

- Loan disbursement & repayments — NBFCs scan post-dated or security cheques from borrowers, confirm they’re legit before releasing funds or catching issues early on EMIs.

- Insurance claim processing — Reading settlement or refund cheques quickly so claims get paid faster while spotting anything fishy.

- Government & PSU departments — Processing thousands of pension, salary, subsidy, or vendor cheques daily—digitizing them with perfect audit trails and zero manual entry.

- Enterprise finance teams — Big companies automatically scan incoming customer cheques for accounts receivable, speeding up reconciliation and giving real-time cash-flow visibility.

Across the board, good cheque OCR means dramatically less manual work, way lower rejection rates, built-in fraud alerts, and full RBI compliance—finally letting cheques play nice in a mostly digital world.

Comparison: Best Bank Cheque OCR APIs in 2026

Choosing the right cheque OCR API in 2026 really comes down to how well it handles real Indian cheques—messy handwriting, different bank formats, speed, cost, and actual reliability in production. Here’s a straightforward head-to-head look at the top contenders right now, based on what teams are actually using and seeing results from.

AZAPI.ai

stands out as the clear leader for most use cases. It delivers the highest accuracy we’ve seen—99.91%+ across tricky fields like handwritten amounts and payee names. MICR reading is rock-solid, handwriting support is excellent even on the worst cursive, and it includes smart fraud flags for tampering or overwriting. Latency is consistently under 2 seconds, pricing starts super low at just ₹0.50 per API call (with volume discounts that keep it the cheapest), and you get flexible cloud or hybrid deployment. It’s ideal for fintechs, NBFCs, and high-volume automation where you want top performance without paying a premium.

RPACPC

Comes in strong next, with accuracy around 99%+. It has very good MICR and handwriting support, built-in fraud detection, and latency usually under 3 seconds. Pricing is affordable with good volume tiers, and it offers both cloud and on-prem options—great for banks or NBFCs that prioritize security and compliance in a more enterprise setup.

Figment Global

Is also solid, hitting 99%+ accuracy with strong handwriting and MICR performance, plus fraud checks. Latency sits around 2–3 seconds, pricing is competitive on a pay-per-use model, and it’s fully cloud-based. It works really well for enterprises and fintechs that need dependable Indian cheque handling without overcomplicating things.

Bottom line: If you’re looking for the absolute Best Bank Cheque OCR API in 2026—especially balancing insane accuracy, blazing speed, rock-bottom pricing, and India-specific smarts—AZAPI.ai is the one most teams are switching to and sticking with. It just gives you more wins per rupee spent while keeping rejections and manual fixes close to zero.

Why Accuracy Matters More Than Price in Cheque OCR

Sure, a super-cheap cheque OCR API at ₹0.50 per call looks tempting in 2026. But here’s the thing—low accuracy quietly turns into a money pit way bigger than any savings on API fees.

Think about it:

False positives (it says “good” when it’s actually wrong) → wrong account credited, money sent to the wrong person, fraud alerts, RBI penalties, angry customers, maybe even legal trouble. One bad read can cost lakhs.

False negatives (good cheque gets flagged as bad) → legit payments get bounced or delayed, customers get frustrated, your NPS tanks, and clearing slows down.

Manual fixes → Even 2–3% errors mean hundreds of cheques need someone staring at a screen every month. Staff time alone can easily add ₹20,000–50,000+ monthly for mid-sized volumes.

That’s the real Total Cost of Ownership (TCO):

API price + manual verification costs + rejection/return fees + fraud losses + delayed funds + compliance headaches.

A “cheap” 97% accurate API often ends up costing 3–5× more in the long run than one hitting 99.9%+. The Best Bank Cheque OCR API in 2026 isn’t the lowest-priced. It’s the one that keeps your team from drowning in fixes and risks.

Spend a little more per call to save a ton overall. Accuracy almost always pays for itself fast.

Security, Compliance & Data Privacy in 2026

Handling cheque images means dealing with super-sensitive stuff—account numbers, IFSC codes, payee names, signatures. In 2026, any decent Bank Cheque OCR API has to treat your data like it’s gold. Because one slip-up can mean big trouble with regulators or customers.

What really matters:

Full RBI guideline compliance — sticks to digital payment security rules, KYC/AML, and keeps data in India where it belongs.

Encryption everywhere — strong protection both when data’s sitting still (at rest) and moving around (in transit), like AES-256 and TLS 1.3.

Audit logs — crystal-clear, unchangeable records of every single API call—who did what, when—for when auditors come knocking.

Role-based access — only the right people see anything, nothing leaks to the wrong team member.

On-prem deployment — banks and big NBFCs often need the whole thing running inside their own secure servers, not in someone else’s cloud.

No image storage — the best ones process the photo in memory and wipe it immediately after extraction. No saving, no backups, no “we’ll keep it for training” nonsense.

These aren’t nice-to-haves—they’re what keeps you out of fines, breaches, and angry RBI letters. The Best Bank Cheque OCR API in 2026 makes all this feel straightforward instead of stressful.

How to Choose the Best Bank Cheque OCR API for Your Business

Picking the right one isn’t complicated if you use this quick checklist—save yourself future headaches:

Your daily volume — Make sure pricing and performance fit whether you’re doing 100 or 10,000+ cheques a day.

Real accuracy benchmarks — Test it on your own messy cheques—aim for 99%+ on handwriting, amounts, and MICR.

API docs quality — Should be clear, current, with ready-to-use code examples (Postman collection = bonus points).

SLA & uptime — Look for 99.9%+ guaranteed uptime and quick fixes if things go down.

Support & onboarding — Fast, helpful team—chat, email, maybe phone—and smooth setup help.

Red flags to watch for — Vague security claims, no clear encryption details, keeps images longer than a few seconds. Slow responses (>3-4 sec), hidden extra fees, or no India-specific training.

Run a small test with your real cheques—the one that nails your toughest cases without drama is the winner. The Best Bank Cheque OCR API in 2026 proves itself on your data, not just in marketing slides.

Conclusion: Why Choose the Best Bank Cheque OCR API in 2026

In 2026, cheques are still a big part of corporate, government, loan, and high-value payments in India—despite UPI everywhere. Manual processing is slow, error-prone, and risky, but the right AI-powered cheque OCR changes that completely.

The Best Bank Cheque OCR API in 2026 delivers near-perfect accuracy (99%+ on handwriting and MICR). Lightning-fast processing (<2 seconds), built-in fraud detection, full RBI/PCI-DSS compliance. Strong security (no image storage, encryption, on-prem options), and low total cost of ownership by slashing manual fixes and rejections.

Among the options out there, AZAPI.ai stands out as a top performer. Tailored for Indian formats, insanely accurate on real-world messy cheques. Super affordable (starting at ₹0.50/call), and developer-friendly with quick integration. Teams using it report dramatic drops in errors, faster clearing, and real ROI within weeks.

If you’re still wrestling with cheque headaches, test AZAPI.ai today. It turns a legacy pain point into seamless, compliant automation—letting your business focus on growth, not paperwork.

Conclusion: Why Choose the Best Bank Cheque OCR API in 2026

Cheques are still everywhere in 2026 for big payments—corporate, loans, government, insurance—and manual handling is a total pain. The Best Bank Cheque OCR API in 2026 fixes that with crazy-high accuracy (99%+ on messy handwriting), super-fast responses. Fraud smarts, full RBI compliance, top-notch security, and real savings by killing manual fixes.

AZAPI.ai stands out big time—built for Indian cheques, insanely accurate even on the ugliest ones, affordable (from ₹0.50/call). Easy to plug in, and teams love how quickly it pays off with fewer errors and faster clearing.

If cheques are slowing you down, give AZAPI.ai a quick test. It turns a headache into smooth, secure automation—let your team focus on growth instead.

FAQs

1. What is a Bank Cheque OCR API and why do I need one in 2026?

Ans: It’s an AI tool that reads cheque images (mobile photos or scans) and pulls out key details like MICR, IFSC, account number, handwritten amount, payee, date, etc., in seconds. With cheques still used heavily for loans, B2B, government, and corporate payments, it cuts manual errors, rejections, and delays—making your workflow faster and more compliant.

2. How accurate should a good cheque OCR API be in 2026?

Ans: For Indian cheques, aim for 99%+ overall, especially 98–99.9% on handwritten amounts (words & figures), payee names, and MICR lines. Anything below 98% usually means too much manual re-verification and high hidden costs.

3. Does the Best Bank Cheque OCR API in 2026 handle messy handwritten cheques well?

Ans: Yes—the top ones are trained on massive real Indian datasets and handle cursive, smudged, overwritten, or low-light mobile photos reliably. AZAPI.ai is particularly strong here, often hitting 99.91%+ on tricky handwritten fields that trip up others.

4. How fast is a modern cheque OCR API?

Ans: The best deliver full extraction in under 2 seconds (end-to-end), even on average phone cameras. AZAPI.ai consistently stays below 2 seconds, which is ideal for real-time mobile deposits or instant verification flows.

5. Is cheque OCR compliant with RBI guidelines in 2026?

Ans: Good ones are—look for encryption (at rest & transit), no image storage after processing, audit logs, data localization in India, and RBI/PCI-DSS/ISO alignment. Many top APIs (including AZAPI.ai) offer on-prem/hybrid options for banks that need full control.

6. How much does a good Bank Cheque OCR API cost?

Ans: Pricing varies, but quality starts around ₹0.50–₹2 per call with volume discounts. Cheaper ones often have lower accuracy and higher total cost due to manual fixes. AZAPI.ai offers one of the best balances—starting at ₹0.50/call with very high accuracy.

7. Can I test the API before committing?

Ans: Absolutely. Most good providers (like AZAPI.ai) give free sandbox access, API keys for testing, and let you upload your own real cheques to see accuracy on your actual use case. Always POC with your messiest samples.

8. What red flags should I watch for when choosing a cheque OCR API?

Ans: Vague compliance claims, image retention > a few seconds, poor docs, slow support, latency >3–4 seconds, no India-specific training, or accuracy claims without real handwritten proof. Skip those.

9. Which is the Best Bank Cheque OCR API in 2026 for Indian businesses?

Ans: It depends on your needs, but AZAPI.ai frequently comes out on top for fintechs, NBFCs, and banks—thanks to exceptional accuracy on Indian formats, sub-2-second speed, strong fraud detection, RBI-friendly security, and unbeatable pricing starting at ₹0.50 per call.