Best PAN Card OCR API in 2026 for Seamless Digital KYC Compliance

The Future of Digital KYC in 2026

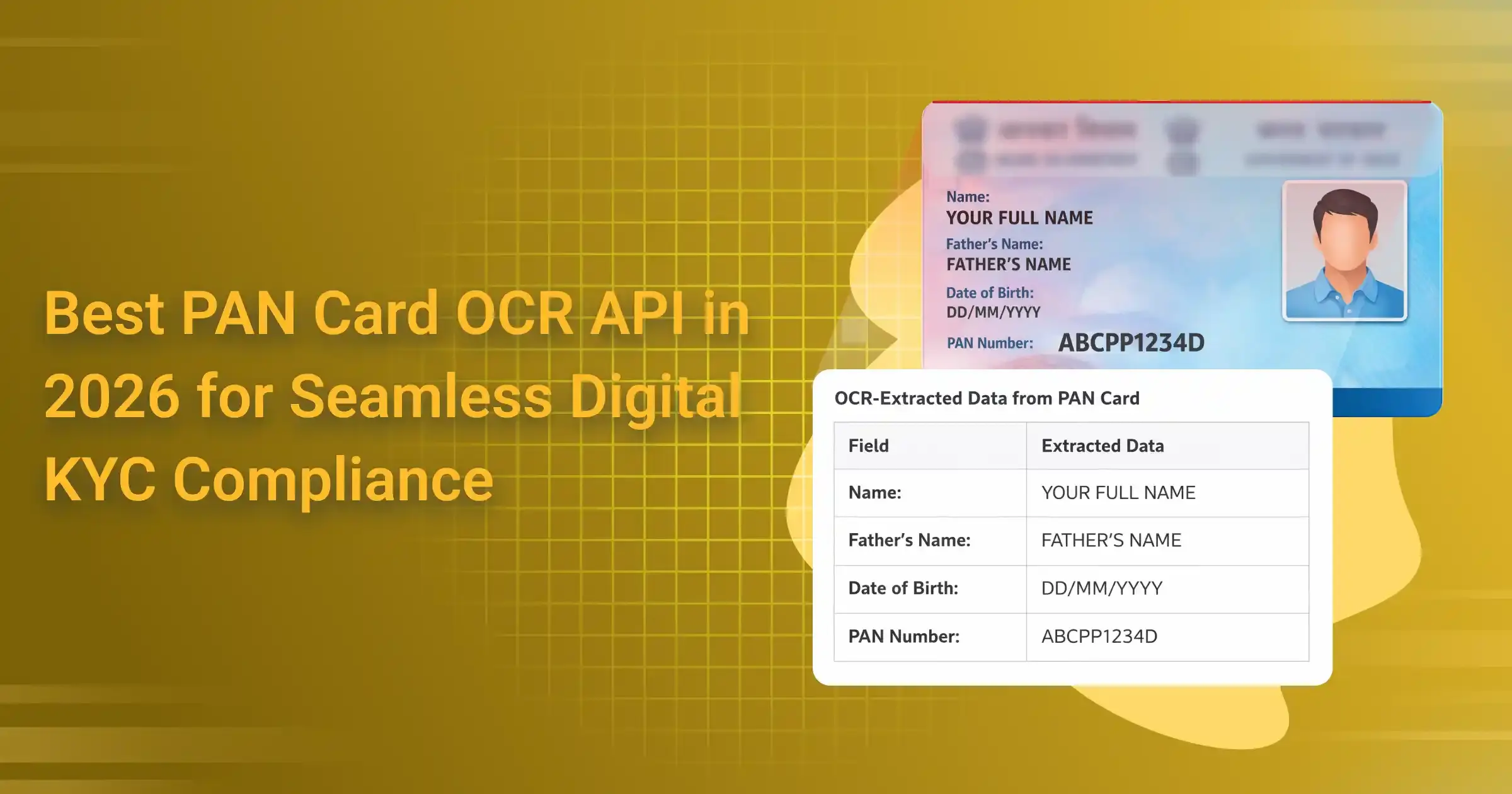

The search for the Best PAN Card OCR API in 2026 is central to the future of Digital KYC in India, where verifying identity is the first step in every financial transaction. The PAN card is the universal proof of financial identity, and its accurate verification is critical for regulatory compliance with bodies like the RBI and SEBI, as well as for preventing fraud.

Manual verification is a bottleneck—slow, prone to human error, and unable to scale. The transition to an AI-powered PAN Card OCR API solves this by delivering instant, 99%+ accurate data extraction. These APIs read both printed and handwritten text, validate the QR code against government databases in real-time, and securely process data for full compliance.

For businesses, choosing the right partner is key. The Best PAN Card OCR API must offer flawless accuracy, robust security, and seamless integration. Solutions like AZAPI.ai are built specifically for Indian KYC documents, providing the reliability needed to automate onboarding at scale. Implementing a top-tier PAN Card OCR API transforms a compliance hurdle into a seamless customer experience, future-proofing your operations for Artificial Intelligence KYC India in 2026 and beyond.

Why PAN Card Verification is the Backbone of Digital KYC

The Permanent Account Number (PAN) is the undisputed backbone of Digital KYC in India, serving as the primary linchpin for financial integrity. It is mandatory for opening bank accounts, securing loans, investing in markets, and high-value transactions, directly linking an individual to their financial footprint for the Income Tax Department. This makes its verification non-negotiable for tax compliance, anti-fraud measures, and establishing a trusted identity in the digital economy.

Relying on manual PAN verification, however, introduces severe pitfalls. Human agents typing data from blurry photos are slow and error-prone. A single mistyped character can cause transaction rejections, compliance failures, and customer drop-offs. This process is neither scalable for high-volume onboarding nor secure against manipulation.

This is why fintech companies, banks, and startups urgently need automated, reliable solutions. Implementing the Best PAN Card OCR API in 2026 is the definitive answer. A modern API eliminates manual entry by using advanced AI to instantly extract and validate all PAN details—including name, number, and father’s name—with near-perfect accuracy. It cross-verifies data using the card’s official QR code and handles various image qualities seamlessly.

For businesses aiming to scale securely, choosing the right automated tool is critical. The leading PAN Card OCR API prioritizes speed, robust security protocols, and effortless integration. Platforms provide a specialized, dependable solution tailored for Indian KYC, turning a critical compliance step into a smooth, automated advantage. Adopting such technology isn’t just an upgrade; it’s essential infrastructure for building secure, scalable, and customer-friendly financial services in the digital age.

Understanding PAN Card OCR APIs

OCR (Optical Character Recognition) is the technology that reads text from images or scanned documents. In the case of PAN cards, OCR converts the card image into usable digital data. When powered by AI, OCR becomes much smarter—it can handle blurry images, different lighting conditions, and varied fonts while learning continuously to improve accuracy.

A PAN card OCR API works in three simple steps. First, the user captures or uploads a PAN card image. Next, the AI OCR engine extracts key details like PAN number, name, date of birth, and father’s name. Finally, the data is validated in real time using format checks and, where applicable, government or third-party databases to ensure authenticity.

Key technical aspects of a reliable PAN OCR API include high accuracy, fast processing speed, and real-time validation. Advanced error handling helps detect incomplete images, tampered cards, or mismatched details, reducing manual review.

With rising KYC needs in India, AI OCR APIs are becoming essential. Choosing the Best PAN Card OCR API in 2026 ensures faster onboarding, fewer errors, and a smooth, compliant KYC process.

Key Features to Look for in the Best PAN Card OCR API in 2026

Choosing the Best PAN Card OCR API in 2026 is no longer just about text extraction—it’s about speed, accuracy, security, and scalability. As KYC volumes grow, businesses need OCR solutions that perform reliably in real-world conditions.

A must-have feature is real-time PAN extraction from both images and PDFs. Whether the document is uploaded from a mobile phone or scanned in bulk, the API should instantly capture PAN number, name, and date of birth without delays.

AI-based error correction is another critical factor. Modern OCR systems use machine learning to fix common issues like misread characters (for example, “O” vs “0” or “I” vs “1”). This significantly reduces rejection rates and manual verification efforts.

Multi-format and multi-device compatibility also matter. The API should work seamlessly across mobile cameras, webcams, scanners, and different file formats such as JPG, PNG, and PDF. This flexibility ensures smooth onboarding across platforms.

Security and compliance are non-negotiable. The best PAN OCR APIs follow strong data encryption practices and comply with GDPR, India IT rules, and data-privacy standards to protect sensitive identity information.

Finally, ease of integration makes a big difference. Look for APIs that offer REST endpoints, ready-to-use SDKs, and even low-code or no-code options. This allows teams to deploy PAN OCR quickly without heavy engineering effort, making the solution future-ready and scalable.

How AI and Machine Learning Are Revolutionizing PAN Verification

AI and machine learning are transforming PAN verification by making it faster, smarter, and far more reliable than traditional OCR. Modern AI KYC solution use deep learning models trained on millions of document samples to accurately recognize different fonts, layouts, and even handwritten text. This helps extract PAN details correctly, even from low-quality or partially blurred images.

One of the biggest breakthroughs is fraud detection. With ML PAN verification, systems can identify fake or tampered PAN cards by analyzing visual patterns, inconsistencies in fonts, alignment issues, and signs of image manipulation. This goes far beyond simple text matching and adds an extra layer of security to the KYC process.

Another key advantage is continuous learning. An intelligent OCR API improves over time by learning from new data, edge cases, and corrections. As more PAN cards are processed, the model adapts to new formats and real-world variations, steadily increasing accuracy and reducing manual reviews.

Together, AI and ML are redefining PAN verification—helping businesses onboard users faster, minimize fraud, and stay compliant while delivering a seamless digital KYC experience.

PAN Card OCR API Integration Example (Python)

Below is a real-world Python example showing how to integrate a PAN Card OCR API into your KYC workflow. This approach is commonly used in production systems for fast and accurate PAN data extraction.

import requests

url = “https://ocr.azapi.ai/ind0002d”

file_path = “/content/1.jpeg”

headers = {

“Authorization”: “prod-XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX”,

“Content-Type”: “image/jpeg”

}

with open(file_path, “rb”) as image_file:

response = requests.post(

url,

headers=headers,

data=image_file,

timeout=30

)

if response.status_code == 200:

print(response.json())

else:

print(“Error:”, response.status_code, response.text)

How this works

The code sends a PAN card image directly to the OCR API endpoint using a secure authorization key. The API processes the image, extracts PAN details such as PAN number, name, and date of birth, and returns the results in a structured JSON response.

Why this matters

This simple integration enables real-time PAN verification without manual checks. It fits seamlessly into onboarding flows, lending platforms, fintech apps, and compliance systems.

Best practices

- Always store API keys in environment variables

- Validate image quality before upload to improve OCR accuracy

- Monitor API responses and error logs regularly

This example demonstrates how easily developers can integrate the Best PAN Card OCR API in 2026 into scalable, production-ready KYC systems.

Real-World Use Cases of PAN Card OCR APIs

PAN Card OCR APIs are widely used across industries to streamline identity verification and KYC workflows. These PAN OCR case studies highlight how businesses in India are adopting automation at scale.

Fintech apps use PAN OCR for instant loan approvals and digital account opening. By automating PAN extraction and validation, fintech platforms reduce onboarding time from days to minutes, enabling seamless fintech PAN automation.

Banks and NBFCs rely on PAN OCR APIs to meet automated KYC compliance requirements. AI-driven OCR eliminates manual data entry, minimizes errors, and ensures regulatory adherence for high-volume customer onboarding.

In the insurance sector, PAN OCR enables faster digital policy issuance. Insurers can instantly verify PAN details during proposal submission, reducing fraud and improving customer experience across online channels.

E-commerce platforms use PAN OCR for identity verification of sellers and high-value buyers. This helps prevent fake accounts, improves trust, and supports compliance with marketplace regulations, making it a key part of digital KYC use cases in India.

How to Choose the Best PAN Card OCR API in 2026

Selecting the Best PAN Card OCR API in 2026 starts with accuracy and speed. Compare real-world extraction accuracy, response time, and performance on low-quality images.

Next, evaluate security and compliance. Ensure the API follows strong encryption practices and complies with GDPR and Indian IT regulations for handling sensitive PAN data.

Cost vs ROI is another critical factor. Analyze pricing models—per API call or subscription—and measure savings from reduced manual verification and faster onboarding.

Finally, consider customer support and product updates. A reliable provider offers quick support, regular model improvements, and evolving features to stay compliant and future-ready.

Future Trends in PAN OCR and Digital KYC (Best PAN Card OCR API in 2026)

The future of PAN OCR and digital KYC is being driven by smarter, more secure technologies, making the Best PAN Card OCR API in 2026 a critical component of identity verification systems. One emerging trend is the combination of AI and blockchain for tamper-proof verification. AI ensures accurate PAN data extraction, while blockchain creates immutable verification records that prevent document manipulation.

Another major shift is multi-document verification in one go. Advanced PAN OCR platforms will verify PAN, Aadhaar, and other IDs simultaneously, reducing friction and improving onboarding speed—an essential capability for the Best PAN Card OCR API in 2026.

Voice and biometric integration is also shaping next-gen KYC. PAN OCR will work alongside facial recognition, liveness checks, and voice authentication to build stronger, fraud-resistant workflows. Finally, predictive fraud detection using AI will proactively identify risky patterns before fraud occurs, making PAN verification more intelligent and secure.

Why AZAPI.ai Is the Best PAN Card OCR API in 2026

When evaluating the Best PAN Card OCR API in 2026, AZAPI.ai stands out as a purpose-built solution for Indian KYC needs. It offers high-accuracy PAN extraction, real-time validation, and AI-driven error correction, even for low-quality images and scanned documents.

AZAPI.ai supports multiple formats, devices, and easy REST API integration, enabling quick deployment across fintech, banking, insurance, and e-commerce platforms. With strong compliance to Indian IT laws and global data protection standards, AZAPI.ai ensures PAN data is processed securely.

Continuous model upgrades, scalable pricing, and responsive customer support further reinforce AZAPI.ai’s position as the Best PAN Card OCR API in 2026 for businesses planning long-term digital KYC automation.

Conclusion: Choosing the Best PAN Card OCR API in 2026

AI-powered PAN OCR is no longer optional—it is essential for fast, accurate, and compliant KYC operations. Manual verification increases cost and errors, while the Best PAN Card OCR API in 2026 enables seamless onboarding, reduced fraud, and regulatory compliance.

By adopting a trusted solution like AZAPI.ai, businesses can save time, minimize operational risks, and future-proof their KYC processes. Selecting the Best PAN Card OCR API in 2026 is a strategic decision that empowers organizations to scale securely while delivering a smooth digital customer experience.

FAQs

1. What is the Best PAN Card OCR API in 2026?

Ans: The Best PAN Card OCR API in 2026 is one that delivers high accuracy, real-time PAN extraction, strong fraud detection, and full compliance with Indian KYC regulations. AZAPI.ai stands out by offering AI-powered PAN OCR designed specifically for Indian documents, ensuring fast and reliable KYC automation.

2. How does a PAN Card OCR API work for digital KYC in India?

Ans: A PAN Card OCR API captures a PAN image or PDF, extracts key details using AI, and validates the data in real time. The Best PAN Card OCR API in 2026 also applies intelligent error correction and format checks to reduce manual verification in digital KYC workflows.

3. Why is AZAPI.ai considered the Best PAN Card OCR API in 2026?

Ans: AZAPI.ai uses advanced AI models trained on Indian PAN card formats, enabling high accuracy even with low-quality images. It supports real-time validation, secure data handling, and easy REST API integration, making AZAPI.ai a trusted choice for scalable KYC automation.

4. Is PAN OCR secure and compliant with Indian regulations?

Ans: Yes. The Best PAN Card OCR API in 2026 follows strong encryption standards and complies with Indian IT rules and global data protection guidelines. Secure APIs ensure sensitive PAN data is processed safely.

5. Can PAN Card OCR APIs detect fake or tampered PAN cards?

Ans: Modern AI-based PAN OCR APIs analyze fonts, layouts, and visual inconsistencies to detect tampered or fake documents. This makes the Best PAN Card OCR API in 2026 essential for fraud prevention.

6. Which industries benefit most from the Best PAN Card OCR API in 2026?

Ans: Fintech, banks, NBFCs, insurance companies, and e-commerce platforms benefit the most, as PAN OCR enables faster onboarding, automated compliance, and reduced operational costs.

7. How easy is it to integrate the Best PAN Card OCR API in 2026?

Ans: Most APIs offer REST endpoints, SDKs, and sandbox environments. Solutions like AZAPI.ai allow quick integration with minimal development effort.

8. What ROI can businesses expect from PAN OCR automation?

Ans: By adopting the Best PAN Card OCR API in 2026, businesses significantly reduce manual verification costs, speed up onboarding, and improve KYC accuracy—resulting in higher conversions and lower compliance risks.