ID Document Recognition API: How Modern Ai Verifies Identity Cards Online (2026 Guide For Businesses)

What You’ll Learn about ID Document Recognition API

By the end of this guide, you’ll understand precisely how businesses verify customer identities instantly using ID Document Recognition API, which tools deliver the best results, and how to avoid the costly mistakes that trip up most companies.

We’ll cover real examples from companies like Groww (India), Opay (Nigeria), and Revolut (Europe) that process millions of verifications monthly.

What Is an ID Document Recognition API? (Simple Explanation)

Think of it this way: You take a photo of your driver’s license or Aadhaar card using your phone. Within 2-3 seconds, an app automatically:

- Reads everything – Your name, date of birth, ID number, and address. Modern systems utilise advanced OCR document readers to extract text accurately, even from blurry or low-quality IDs.

- Checks if it’s real – Detects if someone photoshopped it or took a picture of a screen

- Matches your face – Compares your selfie to the photo on the ID

- Gives a yes/no answer – Approved, needs review, or rejected

The magic? No human is involved. It’s artificial intelligence (AI) doing what used to take 10-45 minutes in under 3 seconds.

Why Every Business Needs An ID Document Recognition API in 2026

The numbers tell the story:

- 700+ million digital accounts opened globally this year

- 380% increase in fake ID fraud since 2022

- $15-$150 lost per successful fraud attempt

- Manual verification costs $4-$25 per person

- API verification costs $0.15-$0.30 per person

For companies onboarding thousands of customers each month, this technology is no longer optional – it’s a matter of survival.

Real example: Groww, an Indian investment app, increased its sign-up completion rate from 40% to 92% just by switching from slow manual checks to instant AI verification.

How Does ID Document Recognition API Actually Work? (Behind the Scenes)

Here’s what happens in those 2-3 seconds:

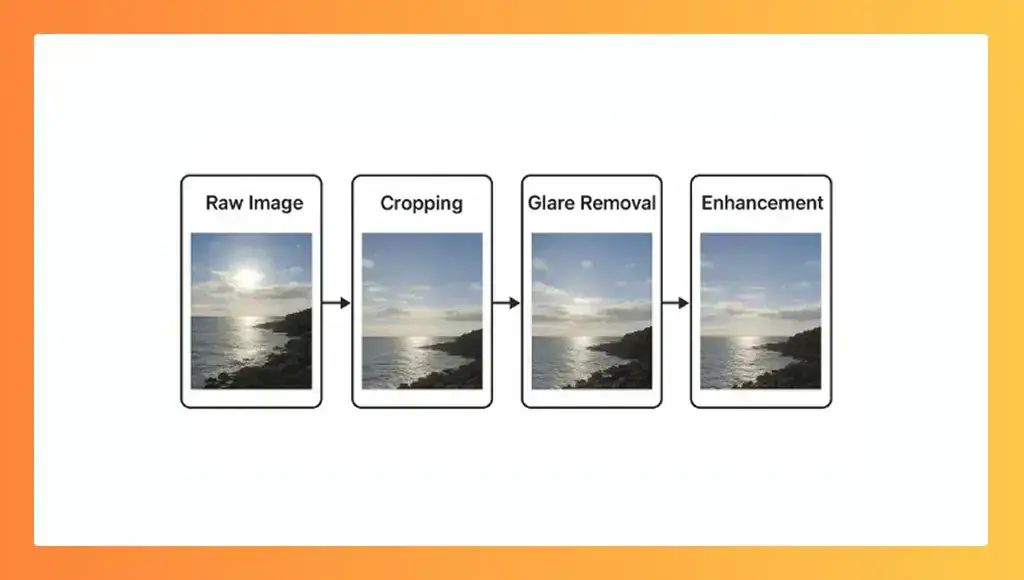

Step 1: Clean Up Your Blurry Photo (0.3-0.6 seconds)

You probably took the photo at an angle with some glare. The AI automatically straightens, removes reflections, and sharpens the text.

Think of it as: Instagram filters but for ID cards – making your terrible photo look professional. These improvements rely on powerful image recognition services that understand document shapes, edges, and lighting.

Step 2: Figure Out What ID This Is (0.1-0.2 seconds)

The system recognises: “Oh, this is an Indian Aadhaar card, 2023 version” or “This is a Nigerian NIN slip” out of 10,000+ document types it already knows.

Why this matters: An Aadhaar card has no expiry date, but a passport does. The system is aware of these rules for every document type.

Step 3: Read All The Information (0.4-0.8 seconds)

Advanced OCR (Optical Character Recognition) extracts:

- Your full name

- ID number

- Date of birth

- Address

- Photo from the card

Better than basic OCR: It handles Hindi text, curly fonts, faded printing, and even slightly damaged cards. This level of accuracy is only possible with modern AI-powered OCR tools designed for multilingual IDs.

Step 4: Run Fraud Detection (0.5-0.9 seconds)

While reading, the AI simultaneously checks:

| Security features are missing or wrong | How AI Catches Them |

|---|---|

| Photoshop a name or number | Detects wrong fonts and pixel tampering |

| Take photo of a screen | Sees moiré patterns (wavy lines) |

| Use someone else’s real ID | Use someone else’s real ID |

| Print a fake ID | Security features missing or wrong |

| Use expired document | Checks expiry date automatically |

Success rate: Catches 98-99% of fakes that humans would miss.

Step 5: Compare Selfie to ID Photo (0.4-0.6 seconds)

If you took a selfie, the system measures how similar your live photo is to the face on the ID.

Scoring:

- 95-100% match = Same person ✓

- 70-94% match = Needs human review

- Below 70% = Different person ✗

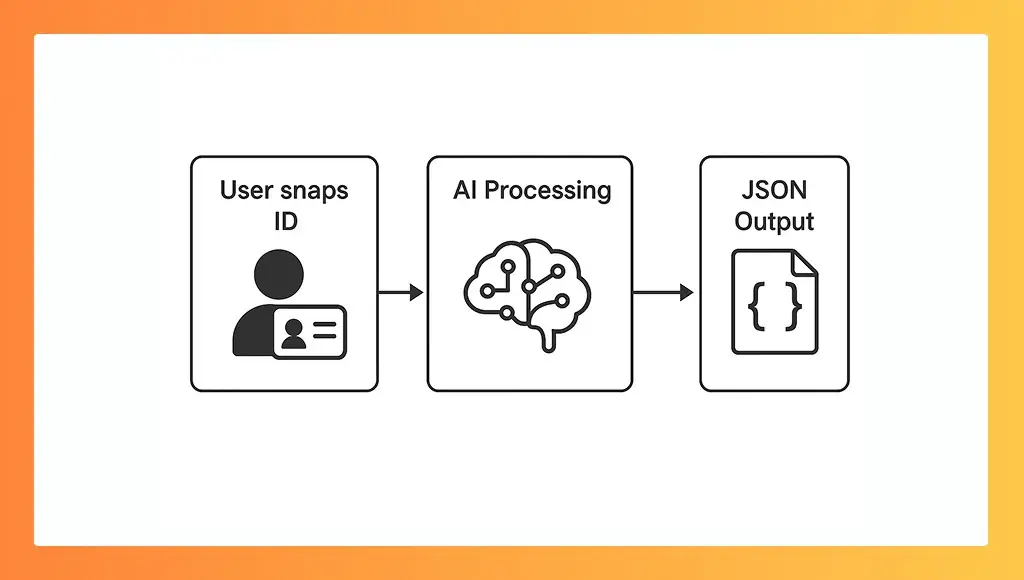

Step 6: Send Results as Clean Data (instant)

Instead of you typing everything manually, you get this:

Total time: 1.5-3.0 seconds. No typos. No human needed.

What Documents Can Be Verified by an ID Document Recognition API?

Modern systems recognise:

Primary IDs:

- Passports (every country)

- National ID cards (e.g., Aadhaar, NIN)

- Driver’s licenses (US: all 50 states)

- Voter cards (India EPIC, Nigeria PVC)

Secondary IDs:

- Tax cards (PAN, SSN)

- Residence permits

- Military/government IDs

Top systems handle over 10,000 document types from more than 200 countries. Many companies rely on specialised OCR solutions to support large-scale document processing for their businesses.

Special Focus: India & Nigeria

Why these markets matter:

- Combined population: 1.64 billion people (20% of the world)

- Fastest-growing fintech markets globally

- Highest fraud rates (challenging but rewarding)

India specifics:

- Aadhaar: 1.39 billion people enrolled

- 99.94% accuracy achievable on Aadhaar cards

- The government provides a free verification API

Nigeria specifics:

- NIN enrollment: 107 million (growing fast)

- Paper NIN slips are common (harder to read)

- 748% fraud increase 2022-2025 (needs better detection)

Online vs In-Person Verification: Which ID Document Recognition API Actually Works Better

| Factor | In-Person (Branch) | Online API |

|---|---|---|

| Time | 10-45 minutes | 30 seconds – 2 minutes |

| Accuracy | 80-85% (human error) | 99.5-99.9% (AI consistency) |

| Fraud detection | 60-70% catch rate | 98-99% catch rate |

| Cost per check | $4-$25 | $0.15-$0.30 |

| Available | Business hours only | 24/7/365 |

| User drop-off | 60-80% | 5-15% |

The verdict in 2026: In-person verification is dying. Only 5% of new accounts require it (mostly elderly customers or specific regulations).

Everyone else? They’ve switched to online verification because it’s faster, cheaper, more accurate, and users actually complete the process.

Real Companies Using ID Document Recognition API Right Now

Fintech (India):

- Groww: 92% conversion rate (was 40%)

- Jupiter Bank: 2M+ users onboarded online

- Time saved: 8 days → 90 seconds

Mobile Money (Nigeria):

- Opay: 30 million users, $1.68 trillion transactions

- MTN: eSIM activation in 5 seconds

- Fraud reduction: 90%

Global Neobanks:

- Revolut: 10M+ users across 30+ countries

- Chime (USA): 35,000 accounts opened daily

- Monzo (UK): 3-minute account opening

The pattern: Snap photo → API verifies → User approved → Happy customer.

How to Choose the Right ID Document Recognition API

We analysed 8+ major providers. Here’s what matters:

Quick Comparison

| Provider | Best For | Accuracy | Price Range | Key Strength |

|---|---|---|---|---|

| AZAPI.ai | India, Nigeria, Africa | 99.94% | $0.15-$0.30 | Emerging markets specialist |

| Veriff | Global enterprise | 99.5% | $1.50-$3.00 | Premium brand, beautiful UI |

| Onfido | UK/EU finance | 99.3% | $1.00-$2.50 | Banking compliance |

| Jumio | USA market | 99.1% | $1.20-$2.80 | Established, reliable |

| Sumsub | Crypto/gaming | 98.8% | $0.50-$1.50 | Fast setup, no-code |

How to Decide

Choose AZAPI.ai if:

- Operating in India, Nigeria, or emerging markets

- Need the best accuracy on challenging documents

- Want predictable, affordable pricing

- Value sub-2-second response times

Pick Veriff/Onfido if:

- Enterprise sales (brand recognition matters)

- UK/EU focused with strict compliance

- Budget allows premium pricing

Select Sumsub/Shufti Pro if:

- Start with a limited budget

- Need to launch fast

- Testing market fit before scaling

7 Critical Mistakes to Avoid (Learn from Others’ Pain)

Mistake #1: Using Basic OCR Only

The problem: Basic text recognition can read “Rahul Kumar” but can’t detect if someone photoshopped it.

The cost: 15-20% of fraud passes undetected, resulting in $50-$150 lost per incident.

The solution: Utilise purpose-built document recognition with built-in fraud detection.

Mistake #2: Poor Image Quality Guidance

The problem: Users submit blurry photos 3-5 times before giving up.

The cost: 34% of verifications fail due to image quality. Users abandon.

The fix: Add real-time feedback:

- “Move closer” when the card is too small

- “Reduce glare” when light reflects

- “Hold steady” when the photo is blurry

Result: First-capture success jumps from 60% to 87%.

Mistake #3: No Manual Review Backup

The problem: 5-15% of legitimate IDs get auto-rejected (damaged cards, unusual names).

The cost: Real customers can’t sign up. Negative reviews pile up.

The fix:

- 95% auto-approved (high confidence)

- 4% enhanced AI review (medium confidence)

- 1% human review (low confidence)

Mistake #4: Skipping Face Matching

The problem: You verify that the document is real, but not whether the person presenting it is the document’s owner.

The cost: Borrowed genuine IDs bypass all checks. Account takeovers increase by 200%.

The fix: Add selfie comparison. Takes three extra seconds—blocks 98%+ of borrowed ID fraud.

Mistake #5: No Fraud Detection Layers

The problem: Extracting data doesn’t mean the document is genuine.

The cost of Synthetic identity fraud has increased 380% since 2022.

The fix: Use providers with:

- Photoshop detection (pixel analysis)

- Screen recapture detection (moiré patterns)

- Font analysis (typography verification)

- Liveness detection (real person, not a photo)

Mistake #6: Ignoring Compliance

The problem: Choosing the cheapest provider without checking certifications.

The cost:

- GDPR fines: Up to €20 million or 4% revenue

- RBI fines (India): ₹25 crore

- Business license revoked

The fix: Verify the provider has:

- ISO 27001 (security)

- SOC 2 Type II (12+ month audit)

- GDPR compliance (if operating in the EU)

- Regional registrations (e.g., UIDAI for India)

Mistake #7: “Set and Forget”

The problem: Fraud techniques evolve. Your system doesn’t.

The cost: Accuracy drops from 98% to 85% after 12 months without updates.

The fix: Choose providers who:

- Update fraud models quarterly

- Add new document types monthly

- Support new government ID versions automatically

What An ID Document Recognition API Costs (Real Numbers)

Pricing by Volume

| Monthly Verifications | Cost Per Check | Total Monthly Cost |

|---|---|---|

| 1,000 – 10,000 | $0.40 – $1.50 | $400 – $15,000 |

| 10,000 – 100,000 | $0.25 – $0.80 | $2,500 – $80,000 |

| 100,000 – 1M | $0.15 – $0.40 | $15,000 – $400,000 |

| 1M+ | $0.10 – $0.25 | Negotiable |

Hidden Costs to Consider

Manual reviews: $0.50-$2.00 each (needed for 2-5% of cases)

Fraud losses prevented:

- Average fraud: $50-$150 per incident

- 98% detection rate = massive savings

Example ROI calculation:

- Cost: $0.30 per verification

- Fraud prevented: $100 × 98% detection = $98 saved

- Manual review saved: $10 per person

- Net benefit: $107.70 per verification

Security & Privacy (What You Need to Know)

Data Protection Standards

Top providers implement:

Encryption:

- AES-256 for stored data

- TLS 1.3 for data transfer

- Military-grade security

Zero-retention:

- Original images deleted after 30 seconds – 5 minutes

- Extract data, then destroy the source

- It can’t be hacked if it doesn’t exist

Certifications to verify:

- ISO 27001 (information security)

- SOC 2 Type II (cloud security)

- GDPR compliance (EU)

- PCI DSS (if handling payments)

Regional Compliance

India:

- RBI e-KYC guidelines mandatory

- UIDAI registration for Aadhaar verification

- Digital Personal Data Protection Act 2023

Nigeria:

- CBN tiered KYC requirements

- NIMC partnership for NIN verification

- NDPR (Nigeria Data Protection Regulation)

Europe:

- GDPR (right to erasure, data minimisation)

- eIDAS for digital signatures

- Data must stay in EU data centres

Implementation: How Long Does ID Document Recognition API Take?

Realistic Timeline

Setup (3-5 days)

- Choose provider

- Get API credentials

- Test in sandbox

Build (7-10 days)

- Create document capture UI

- Connect API endpoints

- Add error handling

- Build a manual review workflow

Launch (3-5 days)

- Beta test with 50-100 real users

- Fix bugs

- Deploy to production

Total: 3-5 weeks for full implementation

What You Actually Need

Technical skills required:

- Basic API integration (standard REST calls)

- Frontend development (camera/upload UI)

- Backend development (webhook handling)

You DON’T need:

- Machine learning expertise

- Computer vision knowledge

- Fraud detection algorithms

Think of it like: Integrating Stripe for payments – you use their AI, not build your own.

The Future: What’s Coming (2026-2030)

2026: Digital Wallets

EU Digital Identity Wallet launches September 2026:

- Store all IDs in one app

- Share with tap (no photo uploads)

- Verification in 0.3 seconds (vs 2-3 today)

India and Nigeria are piloting similar systems.

2027-2028: Predictive Fraud AI

Self-learning systems that adapt within hours:

- A new fraud technique appears at 9 AM

- Detected across platforms by noon

- All systems are protected by 2 PM

- 99.8% fraud detection (vs 98% today)

2029-2030: Invisible Verification

No more “take a photo”:

- Walk into the bank → Face recognised automatically

- Join video call → Voice + face verified silently

- Apply for a job → Continuous background authentication

The goal: You never actively “verify” – it just happens.

Your Next Steps (Action Plan)

If You’re Starting Fresh

Week 1:

- List your requirements (countries, volume, budget)

- Sign up for 2-3 provider trials

- Test with 20-30 real documents from your markets

Week 2-4: 4. Compare accuracy, speed, and cost 5. Select a provider and integrate it in the sandbox. Beta test with 100 users

Week 5: 7. Deploy to production 8. Monitor metrics (completion rate, fraud rate) 9. Optimise based on data

If You’re Upgrading

This Quarter:

- Audit current system (accuracy, cost, user experience)

- Calculate actual cost (include manual reviews + fraud losses)

- Test new providers in parallel

Next Quarter: 4. Migrate gradually (10% → 50% → 100%) 5. Compare results vs the old system 6. Complete switch when validated

Key Takeaways

Speed matters: 30 seconds vs 30 minutes determines who wins customers

Accuracy matters: 99% detection vs 60% determines who loses money to fraud

UX matters: 95% completion vs 65% determines who grows

Cost matters: $0.30 vs $10 per verification determines who scales profitably

The companies winning in 2026 – Groww, Opay, Revolut, Chime – all made identity verification a strategic priority.

The companies struggling are still using manual reviews or basic OCR from 2020.

The Bottom Line

For businesses in India, Nigeria, or anywhere with digital onboarding, an ID document recognition API isn’t just technology – it’s the foundation of growth.

The question isn’t “Should we invest in ID Document Recognition API?”

The question is, “Can we afford to fall behind competitors who already have?”

For most businesses, the answer is clear: implement modern verification now, or spend 2027 explaining why your conversion rate is 30% lower than industry standard.

Frequently Asked Questions

Ans: Top systems achieve 99-99.9% accuracy on data extraction and 98-99% fraud detection. This exceeds human accuracy (80-85%).

Ans: $0.15-$0.40 per verification for most businesses. Volume discounts available. Compare to $4-$25 for manual verification.

Ans: 3-5 weeks for complete implementation. No ML expertise required – just standard API integration skills.

Ans: Yes. Top providers utilise AES-256 encryption, automatically delete images after processing, and maintain ISO 27001/SOC 2 certifications.

Ans: Approximately 95% of verifications are completed on mobile devices, but desktop uploads are also supported. For elderly users, consider agent-assisted options.

Ans: Cloud APIs require an internet connection. For offline capability, use on-device SDKs (such as Regula), although these are more expensive and more challenging to implement.

Ans: AZAPI.ai consistently delivers 99.94% accuracy on Aadhaar, PAN, NIN, and other emerging market documents at an affordable price.

Ans: Highly recommended. Without it, you verify the document is real, but not that the person presenting it is the document owner. Adds 3 seconds, blocks 98%+ fraud.