Bank Statement OCR API

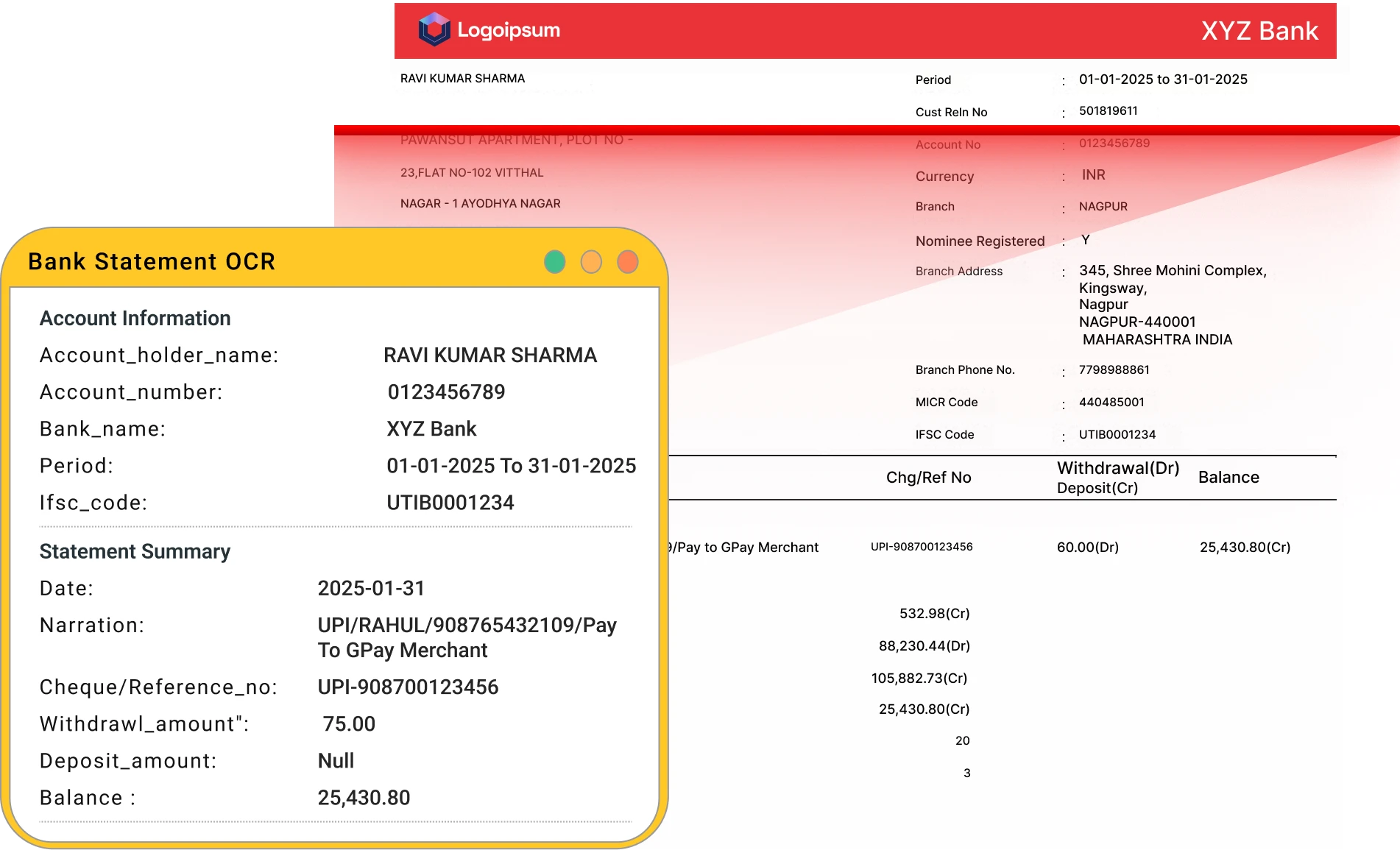

Managing financial data manually takes time and often leads to costly mistakes. With Bank Statement OCR API, you can simplify data entry and turn complex bank statements into accurate, structured information within seconds. This powerful solution helps businesses, accountants, and finance teams gain clarity without the hassle of manual processing. Bank Statement OCR API eliminates errors caused by human input. You get clean, reliable data every time, helping you make better decisions and keep records up to date. No more wasting hours entering transactions line by line. Instead, you save valuable time that you can invest in analysis, strategy, and growth.

Accuracy matters when handling sensitive financial details. Bank Statement OCR API ensures every transaction is captured precisely, giving you confidence in your reports and audits. It reduces compliance risks and strengthens financial transparency. Whether you deal with monthly statements, bulk data, or multi-bank records, this tool adapts seamlessly. Efficiency also improves collaboration across your organization. Teams can share consistent, ready-to-use data instantly, without delays or misinterpretation. This speed and reliability enhance productivity and unlock smarter ways to manage finances.

Bank Statement OCR API is not just a tool—it’s a smarter way to handle your money-related documents. With automation at the core, you cut down on repetitive work, gain accuracy, and free your focus for higher-value tasks.